|

Getting your Trinity Audio player ready...

|

Central banks have been exploring the use of central bank digital currency (CBDC), and alternate member of the governing board of the Swiss National Bank (SNB) Thomas Moser made the trip to the CoinGeek Conference at London to give insight into the Swiss central bank’s view on digital currencies.

Forms of money that have counterparty risk

Thomas Moser explained the different types of money that carry counterparty risks and the ones that don’t.

Central banks by definition have no counterparty risk as they produce money and cannot go bankrupt. Regular consumers do not deal directly with central banks, only commercial banks can have accounts with central banks. The commercial bank can then provide the consumer with a bank account and then there becomes a counterparty risk.

Economists say that money is a substitute for trust, and that you don’t need to trust the counterparty. Currently bank notes and gold are the only traditional monetary assets that do not have any counterparty risk. Moser also acknowledged with the emergence of Bitcoin it also falls into this category, saying, “When you get a Bitcoin, there is no counterparty risk involved. The problem is, at least at this stage is that it not widely accepted.”

Thomas also touched on the price fluctuations being a problem when you are using it for payments, but admitted it does not matter as much if you are saving in Bitcoin.

Moser added that the price fluctuations have tried to be mitigated in the cryptocurrency space with stable coins but stated that they, “introduce this counterparty risk by promising you that you can redeem that stable coin for central bank money again.”

Central banks looking at wholesale and general purpose CBDC

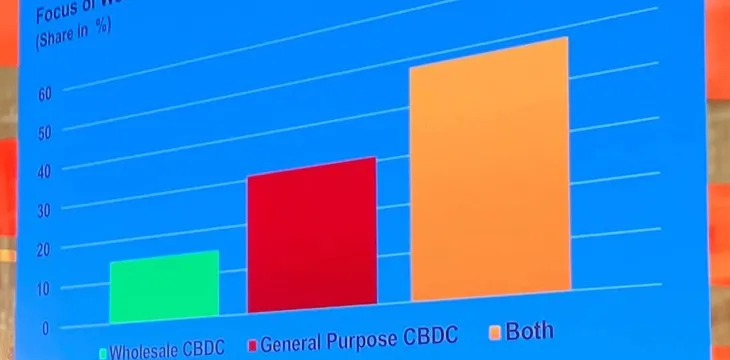

The Bank of International Settlement has issued a survey three years in a row asking the various central banks if they are working on their own form of CBDC.

Over 80% of the respondents stated that they are working on a CBDC solution and it has been broken down into one of the following 3 categories:

A wholesale solution would mirror today’s model where central banks only offer accounts to commercial banks, whereas a general purpose solution would open up the doors to all customers.

Maser stated that the likelihood of the central bank issuing a general purpose CBDC in the next three years is 10% and even less for a wholesale CBDC.

The main driver is to improve payment efficiencies, have financial stability and financial inclusion. Currently payments across borders can take several days, and they have learned with Bitcoin that payment systems can be made to be instant and at an extremely low cost.

Exploring various proof of concepts that will go live this year

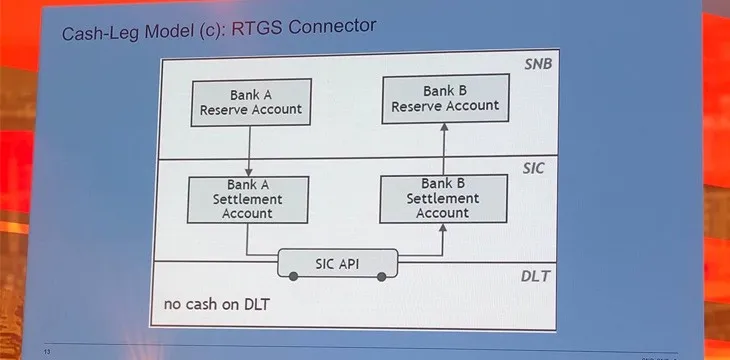

The SNB is exploring options in making digital central bank money available for the trading at the settlement of tokenized assets between financial participants with various proof of concepts that will go live this year.

These proofs of concepts range from producing their own stable coin, tokenization and even just attaching their existing settlement system to a private blockchain to understand if they can get more efficiency from their existing real time gross settlements process across banks and borders. The preference is to find a working solution that eliminates the need for any counterparty risk.

Whilst unclear if they will leverage off Bitcoin’s public and distributed ledger to begin with, it appears that the Swiss central bank is looking to explore and exhaust all avenues testing a variety of different proof of concepts to start with.

If they opt to use a private blockchain there could be a variety of reasons they may not succeed. This could be due to eliminating the main benefits of blockchain that can be attained by using a single universal source of truth ledger, leveraging off the security advantages provided through proof of work mechanism and economic incentives built into the Bitcoin system that has withstood the test of time over the past decade. And of course, the efficiency, scalability, transparency, auditability, interoperability and distributed nature it provides whilst keeping costs at a minimum.

“We think it is a relevant experiment for other central banks. The way we look at CBDC, we look at it from the infrastructure side, what kind of infrastructure is being built out there with blockchain? If you trade on this blockchain, how do you pay with this blockchain? What type of money do you want to have on the blockchain?” Moser said.

Time will tell during the year as the experiment plays out. One thing is for sure, central banks around the world are no longer ignoring this disruptive innovation and are acting.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

09-17-2025

09-17-2025