|

Getting your Trinity Audio player ready...

|

As the Turkish Lira continues its descent against other currencies, more and more people in Turkey are seeking out cryptocurrencies as a safe haven.

Last week, the 24-hour trading volume in cryptocurrency exchange BTCTurk spiked from $5.25 million to $13.95 million, a 166% increase. Although volume quickly stabilized to previous levels, this week, volume once more reached the $14-million level, up 350% in a 24-hour period. At present, volume is at around $9.3 million. Such volatility and volumes have been observed in the country’s other cryptocurrency exchanges, Paribu and Koinim.

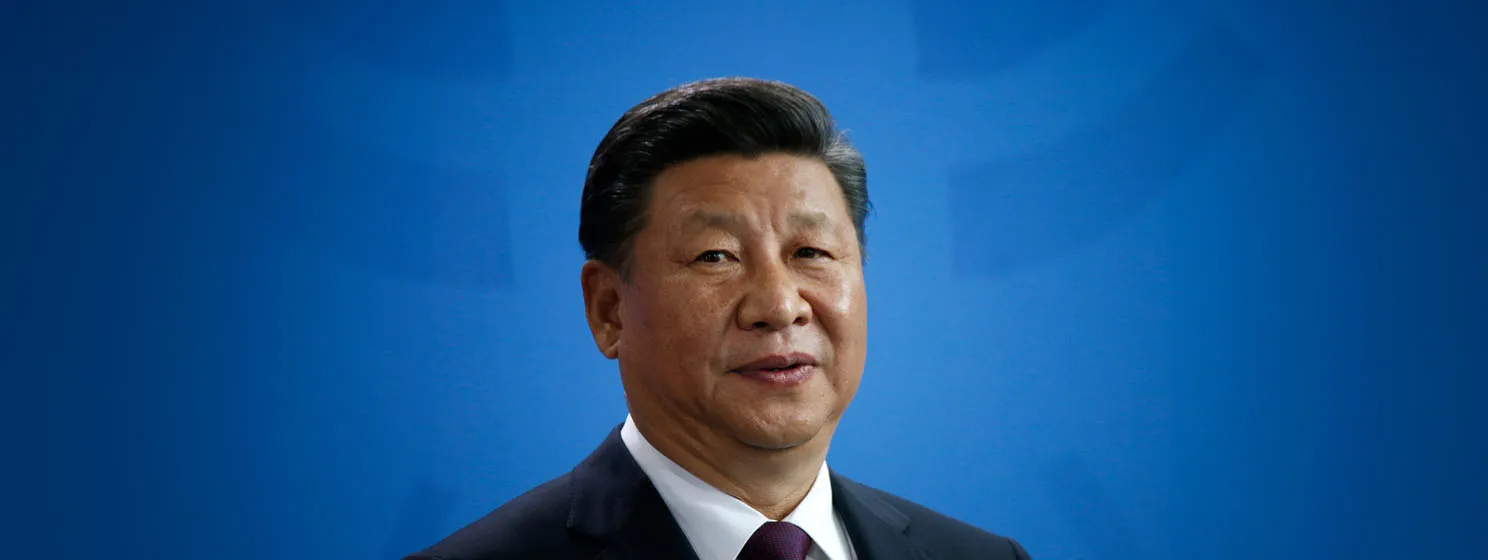

The trading activity comes amid economic sanctions imposed on Turkey by the United States. U.S. President Donald Trump tweeted late last week that he was imposing a 20% tariff on Turkish aluminum and a 50% tariff on Turkish steel as retaliation against Turkish President Recep Tayyip Erdogan for the continued incarceration of American pastor Andrew Brunson in Turkey.

The value of the Lira is at an all-time low, hitting nearly 7 lira to the U.S. dollar, from 5 lira to $1 in July. As poorly as it has performed, Lira is actually only the third-worst performing currency in 2018. The Sudanese Pound’s value has gone down from 7 pounds to $1, to at present 18 pounds to $1. And the Venezuelan Bolivar Fuerte, officially, went from 10 to $1, to over 170,000 to $1, as a result of President Nicolas Maduro’s hyperinflationary policies. Maduro has since declared the creation of Venezuela’s very own cryptocurrency, the Petro, supposedly backed by the country’s oil and mineral reserves. In addition to this, the Venezuelan government has scheduled the circulation of the Bolivar Soberano, to be backed by the Petro, for August 20.

Turkish official Recep Tayyip Erdogan has also proposed the creation of a national cryptocurrency. Former Industry Minister Ahmet Kenan Tanrikulu suggested in February for such a coin to be backed by government-owned assets, even as Erdogan back then did not signal his interest in the matter.

07-09-2025

07-09-2025