|

Getting your Trinity Audio player ready...

|

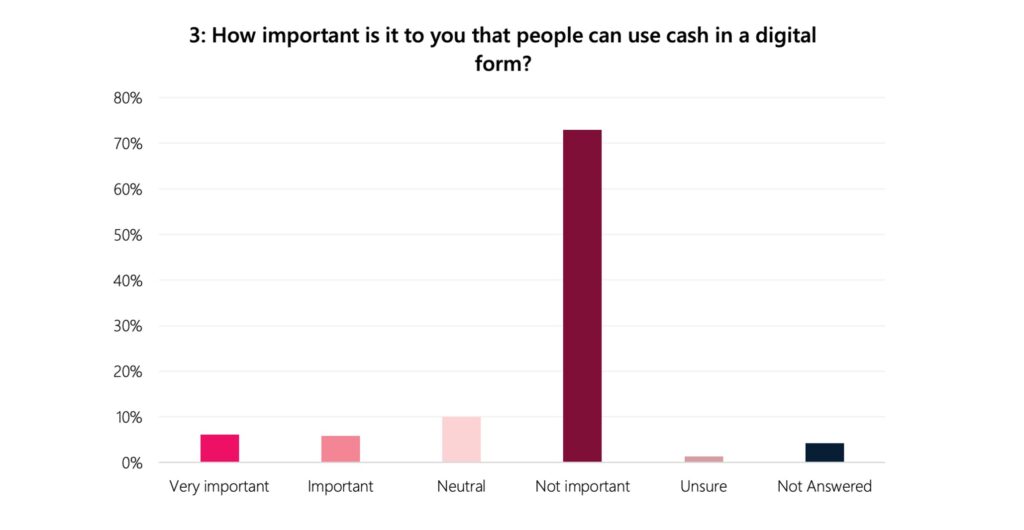

A central bank digital currency (CBDC) is “not important” to nearly three in four New Zealanders, and 90% believe the government will use it to monitor the citizens, a public consultation by the country’s central bank has revealed.

The Reserve Bank of New Zealand (RBNZ) started the consultation in April, calling on the public to submit feedback on whether a CBDC was necessary, whether the bank should pay interest, whether there should be a holding limit and more.

RBNZ recently published the consultation results, which are overwhelmingly against a digital dollar. Around 75% of the 18,000 survey responses said that a CBDC is “not important,” while another 10% were neutral. Only 5% of the respondents say a digital dollar is “very important.”

The response is not unique to the island nation. Similar surveys in developed economies have found that most citizens don’t see the need for a digital form of their currency.

A Bank of Canada (BOC) consultation found that 85% of Canadians “would not use a digital Canadian dollar.” In the United States, only 16% support the idea of a CBDC, and with Donald Trump assuming office in January, the chances of a digital dollar have dipped significantly. New Zealand’s neighbor, Australia, has also stated that there lacks a “clear public interest case” for issuing a retail CBDC.

In New Zealand, the RBNZ stated its key reasons for exploring a digital dollar are to ensure that central bank money remains available to New Zealanders and to enable a competitive and innovative payment system. When asked if they agreed with the bank’s reasons for investigating digital cash, over 80% of the respondents said ‘no.’

Privacy is the top concern for New Zealanders

Privacy remains the primary concern with a CBDC. Around half the respondents cited “free from government control” as the most important feature of a digital dollar. Offline availability and zero fees were the other major features.

The need for privacy is not limited to New Zealanders. A Reserve Bank of Australia (RBA) study in April found that Australians value privacy over safety. The central banks of England, Brazil, Hong Kong, and dozens of others are investing in privacy as a primary feature of their CBDC projects. Assurances by these central banks that they won’t access user data, two-tier systems where commercial lenders handle the consumer data, and zero Know Your Customer (KYC) for small payments are some of the proposed solutions.

RBNZ acknowledged the need for privacy, admitting that there is still work to be done on it.

“You [the public] are concerned about privacy, and so are we. If Digital Cash is introduced, it will be designed to be private. Neither the government nor the Reserve Bank could see how you spend your money. But we would still need to protect against funding terrorism, organized crime and money laundering,” it states.

Expectedly, institutions were less concerned about privacy. The survey showed that most institutional respondents cared more about easy access and intermediation and preferred wholesale CBDC or tokenized deposits.

Thai lender KBank launches blockchain cross-border payments

Elsewhere, one of Thailand’s largest banks, Kasikornbank (KBank), has launched a cross-border payments solutions powered by blockchain technology.

KBank launched the project through Orbix Tech, a fully owned blockchain subsidiary. It also partnered with StraitsX, a Singapore-based blockchain startup whose Singaporean dollar-pegged stablecoin, XSGD, will be used for cross-border payments.

The project will initially be limited to the Singapore-Thailand corridor. KBank will issue Q-money (which is Thai baht on its internal blockchain network) to its Thai users, who can then spend it directly on Singaporean stores without any extra conversions. They will need to scan QR codes, and the KBank app will display the exchange rates, convert the Thai baht to XSGD, and then pay the merchants in Singaporean dollars.

The product is currently operating under a Bank of Thailand (BOT) regulatory sandbox framework. Once it gets the full regulatory green light, KBank intends to scale it up to enable foreign tourists in Thailand to seamlessly make payments in local stores.

The new solution is an evolution of an earlier product by KBank that relied on JPM Coin to make cross-border payments. JPM Coin was JP Morgan’s (NASDAQ: JPM) stablecoin, which was rebranded last month as Kinexys Digital Payment as the bank expanded the scope to include tokenization.

“KBank is committed to developing digital technologies and cross-border payment innovations through blockchain technology for real-time transactions. This is a pivotal step in transforming financial transactions to be more convenient, faster, and secure,” commented KBank executive president Karin Boonlertvanich.

Watch: CBDCs are more than just digital money

03-10-2026

03-10-2026