Coinbase (NASDAQ: COIN) is making it easier for U.S. customers to keep the taxman happy and off their backs. The company has announced the creation of several tools for its platforms that will allow its customers to include crypto trades when filing their federal tax returns, as well as, in some cases, state tax returns.

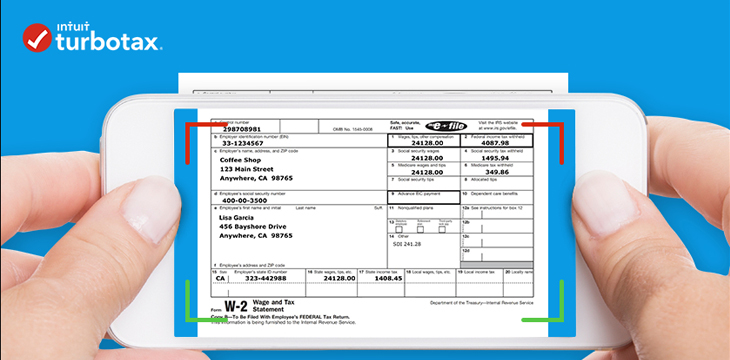

A blog post on the company’s website from yesterday indicates that it has added support for TurboTax, one of the most popular tax-filing software applications used in the U.S. It has also added an educational guide on taxes and crypto, as well as support on Coinbase.com and Coinbase Pro that will allow users to automatically import transactions into a section of TurboTax Premier that is designed exclusively for crypto.

According to the post, “TurboTax has created a new crypto tax section in its TurboTax Premier product allowing you to upload your transactions and account for gains and losses. Coinbase customers can now upload up to 100 Coinbase transactions at once and get a discount to TurboTax products…”

Coinbase has also partnered with CoinTracker to allow users to easily summarize their crypto transactions from last year, regardless of what exchanges or wallets were used. CoinTracker and TurboTax have a separate partnership that allows data to be uploaded to the tax software, providing a “comprehensive view” of crypto activity.

Coinbase will only submit paperwork for customers who meet certain conditions. Those who use Coinbase Pro, Prime and Merchant and who meet the minimum of $20,000 in gross proceeds and 200 transactions last year will be sent the IRS Form 1099-K. Customers of those platforms in Arkansas, Massachusetts, Mississippi, Montana, New Jersey, Vermont and Washington, D.C., where the threshold is lower, will also receive the form.

A different segment of customers, those who use Earn.com and who earned more than $600 in crypto activity, will receive a different form, Form 1099-MISC.

Taxes and cryptocurrency implications are still an unclear topic in the U.S. The Securities and Exchange Commission (SEC), in general, defines them as securities and the Commodity and Futures Trading Commission (CFTC) asserts they’re commodities. The Financial Crimes Enforcement Network says they’re a form of money and the IRS (Internal Revenue Service) has asserted that most crypto is property.

This lack of clarity, coupled with many other obstacles, is why the crypto space in the U.S. has not been able to evolve and why more blockchain and crypto companies have moved overseas. Until the U.S. can determine how to better define the industry, it will continue to lag behind the rest of the world.

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.