|

Getting your Trinity Audio player ready...

|

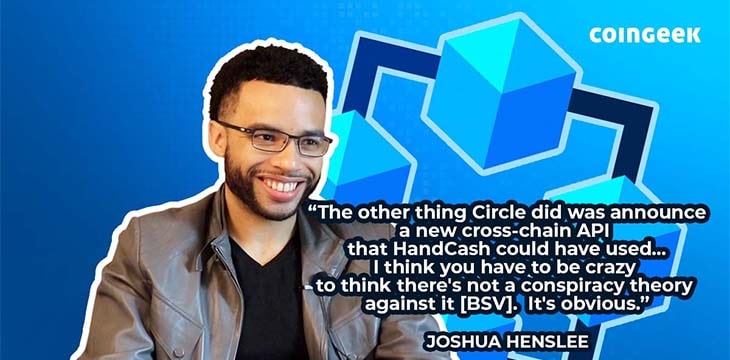

After a brief hiatus, Bitcoin developer Joshua Henslee was back with another video. In this one, he speculated why stablecoin issuer Circle suddenly terminated its HandCash USDC accounts.

Circle terminated its agreements with HandCash without warning

Dear friends,

We have received a few minutes ago some unexpected news: Circle has decided to drastically terminate all our agreements, effectively immediately.

This means our top-up systems with debit card have stopped working. Our team is working on a replacement.

Stay tuned

— HandCash (@handcashapp) January 31, 2023

Henslee recaps what most in the BSV ecosystem know by now: Circle abruptly terminated its agreements with HandCash right before it was supposed to go live. “I don’t know the status of it, but it may not see the light of day at this point,” he says.

While HandCash says it’s still possible to integrate via other means, Henslee says it most likely won’t work the way it was supposed to. He calls it a “huge blow” on top of the recent Robinhood (NASDAQ: HOOD) delisting. On the latter subject, he says that previous delistings were political, but the Robinhood one probably wasn’t; it’s down to lack of volume and the wider macroeconomic picture.

The conspiracy against BSV continues

“The other thing Circle did was announce a new cross-chain API that HandCash could have used…I think you have to be crazy to think there’s not a conspiracy theory against it [BSV]. It’s obvious,” Henslee says.

USDC running on BSV would have been ideal, Henslee points out, noting that the fees would be extremely low for USDC users, and it would have been a huge boon for the BSV ecosystem. “The really terrible part about all of this is how long they were working on this and how far they went with it,” he says, pointing out the risk. Lots of time was potentially wasted. “This is how you continue to slow this stuff down—delay, delay, delay. You want to keep the lid on the geyser as long as possible.”

Henslee expresses his disappointment and notes that the regulatory paperwork probably has to be redone even if HandCash finds another provider.

Wrapping up, Henslee reminds us that we can’t rule out the possibility Circle itself may be having issues. Without being specific, he notes that there was some reporting regarding issues with redemption recently, and perhaps that is one reason for the sudden termination of agreements with HandCash.

Key takeaways from this Joshua Henslee video

- Stablecoin issuer Circle has terminated its agreements with HandCash without warning.

- Henslee views this as part of the ongoing conspiracy against BSV. While he doesn’t consider the Robinhood delisting in the same light, he does think the Circle termination is part of the broader agenda against Satoshi’s original Bitcoin.

- Henslee feels for the team at HandCash, noting how much time and effort they put into the USDC integration and how close they were to the finish line. He doesn’t blame anyone involved but says that, in hindsight, it was apparent this would happen.

- He says we can’t totally rule out the possibility that Circle itself may be having issues we don’t know about. Time will tell.

Watch: Making Blockchain Easy for Real World Use

03-03-2026

03-03-2026