|

Getting your Trinity Audio player ready...

|

South Africa’s financial regulator has issued 63 licenses to VASPs, bringing the total number of licensed digital asset firms to 138.

The Financial Sector Conduct Authority (FSCA) announced recently that it has received 383 applications from VASPs since its new regulatory framework took effect. The first batch of licensees, including leading exchanges Luno and VALR, were revealed earlier this year.

Of the 383, 80 were voluntarily withdrawn by the applicants, the FSCA revealed. These entities can apply again in the future, “provided they can demonstrate full and proper compliance with the applicable licensing requirements.” However, they must cease all digital asset activities immediately.

The watchdog declined five applications from unnamed entities that failed to meet operational ability or competency requirements.

With its new licensing regime, South Africa has become the regional leader in digital asset regulation in Africa. Others like Kenya, Nigeria and Ghana still lack formal frameworks despite a significant share of their populations owning digital assets.

The UN estimates that around 8.5% of Kenyans own digital assets, the fifth-highest share globally. In Nigeria, digital asset transaction volume hit $57 billion between July 2022 and June 2023. Yet, these two countries continue to practice regulation by enforcement and taxation, with Nigeria’s crackdown intensifying this year.

South Africa’s clear regulatory framework is now poaching VASPs from other African countries. One of these is Kenyan stablecoin payments startup Kotani Pay, which despite being based in Nairobi and doing most of its business in the East African nation, is now licensed by the FSCA.

South Africa’s regulatory framework also allows local regulators to crack down on digital asset criminals and protect investors. The FSCA recently revealed in its annual regulatory actions report that it had launched 30 digital currency-related probes.

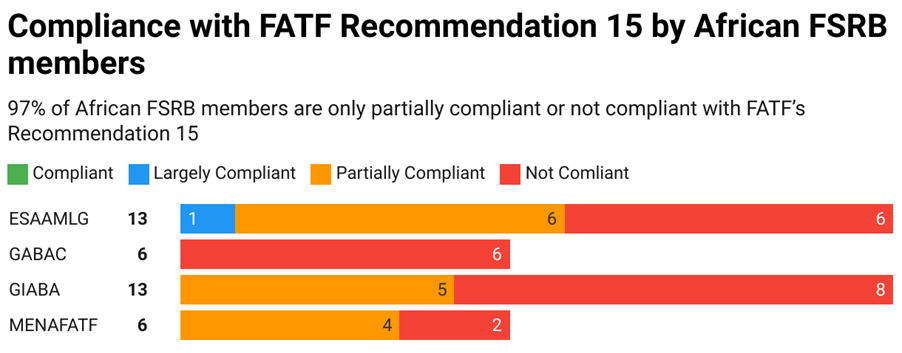

A well-laid-out regulatory framework further guides VASPs and allows them to comply with local and global guidelines, which African startups have been struggling with. According to the FATF, 97% of African countries are either only partially compliant or non-compliant with its digital asset guidelines.

Watch: Reviving the true value of blockchain—utility

02-20-2026

02-20-2026