|

Getting your Trinity Audio player ready...

|

Singapore’s central bank has flagged digital payment tokens (DPTs) as avenues for money laundering alongside casinos and precious stones and metals.

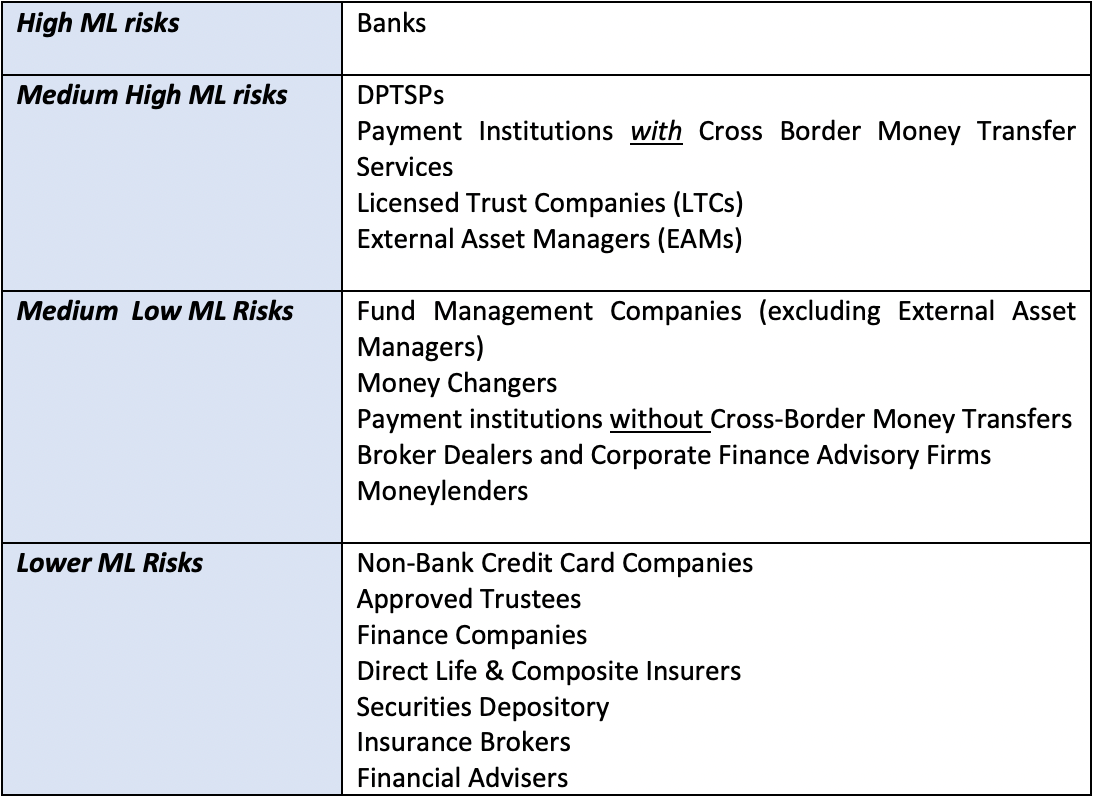

In its ‘2024 Money Laundering Risk Assessment Report,’ the Monetary Authority of Singapore examined the biggest threats to the country’s anti-money laundering (AML) efforts, identifying formal banking as the highest-risk sector.

Despite implementing stronger controls for commercial lenders, the sector has “inherent exposure to key money laundering threats and cross-border transactions/customers,” it noted.

DPT service providers (DPTSPs) were on the second tier alongside other non-bank payment institutions, licensed trust companies and external asset managers.

MAS revealed that its research unearthed cyber-enabled fraud, ransomware and darknet transactions as some of the biggest sources of illicit transactions in digital assets. Hacks and terrorist financing were also observed as substantial threats.

In recent years, Singaporean enforcement agencies have reportedly observed an increase in reported cases involving digital assets. A majority involved investment scams, most of which operated from other countries but targeted Singaporean investors.

However, while the number of digital asset money laundering and fraud cases has increased, so has the AML and Know Your Customer (KYC) programs among virtual asset service providers (VASPs).

MAS noted that the number of suspicious transaction reports (STRs) involving digital assets has shot up, “indicating better risk understanding and awareness amongst the regulated sectors that deal with DPTs.”

The central bank has also stepped up its oversight of the budding industry. In 2020, it pushed for the implementation of the Payment Services Act, which requires VASPs to obtain a license and subjects them to stringent oversight.

MAS revealed that since then, around 240 firms have filed license applications. However, as of the end of December, it had only licensed 19 VASPs.

Despite digital assets being more prone to money laundering, the central bank said it’s not as concerned because Singaporean DPT activity forms a small portion of the global volume and is dwarfed by the country’s banking sector’s significance globally. Digital assets are also rarely used for payments locally, further reducing the threat.

“Maintaining Singapore’s reputation as a trusted hub is important for our continued dynamism as a business and financial centre. It is therefore important for us to ensure that our anti-money laundering regime is robust and risk-focused,” commented Thong Leng Yeng, who heads AML supervision at MAS.

Singapore is recovering from its largest money laundering scandal, involving nearly S$3 billion ($2.1 billion), some of which was held in digital assets.

The country has learned its lessons and is quickly plugging any AML deficiencies. Three months ago, the MAS announced new amendments to its Payment Services Act, expanding its jurisdiction over VASPs.

Watch: BSV blockchain—Ignite the power of data for finance and banking

03-09-2026

03-09-2026