|

Getting your Trinity Audio player ready...

|

Central bank digital currencies (CBDCs) may have lost some of their allure globally, but Rwanda is marching on with its CBDC project. The country’s central bank is calling on citizens to pitch in with their ideas on how to best implement a digital Rwandan franc.

Further south, Botswana has launched a feasibility study to evaluate the risks and benefits of a CBDC.

Rwanda targets payment innovation, cheaper remittances with CBDC

The Central Bank of Rwanda (BNR) has launched a retail CBDC ideathon, inviting any Rwandan citizen, company, startup, or corporation to share their proposals and help shape the country’s digital payments future.

BNR says it intends to involve all financial industry stakeholders from the start to “foster innovation and competition in the digital finance ecosystem,” in line with the country’s National Fintech Strategy (2024-2029).

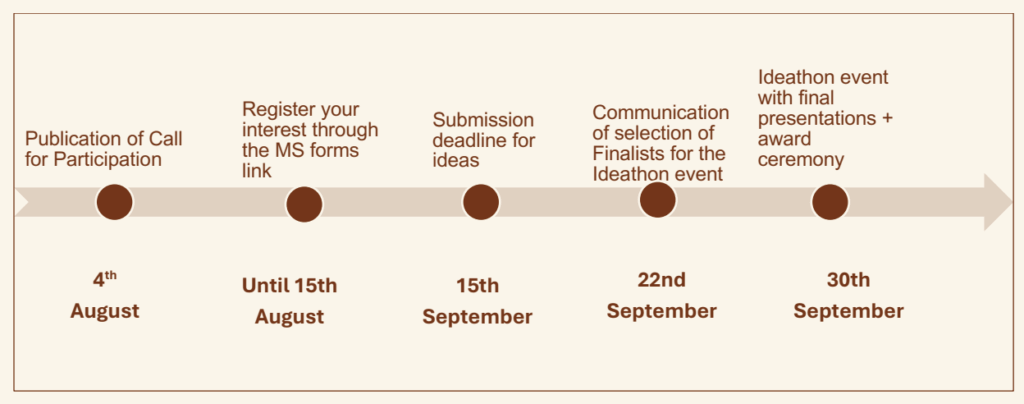

Rwandans have until August 15 to register their interest, and one month after that to submit their ideas. By the end of September, the bank will have selected the best ideas and awarded the ideators.

Rwanda remains among a few countries in Africa that have retained interest in CBDCs, with most now exploring other financial innovations as the CBDC hype has died down. Some, like Kenya, say a digital currency isn’t a priority as financial inclusion is already high. Others, like South Africa, are monitoring global developments but are exploring alternatives like stablecoins.

Nigeria is the only African nation to launch a digital currency with its e-Naira, but adoption has been disappointing. Local companies are now shifting to stablecoins, with cNGN launching earlier this year as the country’s first regulated stablecoin.

Still, Rwanda persists with its CBDC project. BNR says it has been conducting closed-loop tests with a limited user group to build a better understanding of the technology, user experience, and potential risks.

The test “focuses on legal frameworks, cybersecurity, and payment system integration,” the bank says.

The participants have included staff from the CBR, local lenders, merchants, and a select group of institutions. The project will run for five months, with the results expected by early October.

The central bank reiterated that the testing doesn’t imply it will launch the digital franc. Instead, it will use the results to guide its next steps.

BNR says it has identified over a dozen potential opportunities but has narrowed in on four major “sweet spots.”

The first is to enhance the resilience of its payments system; the CBDC would be accessible offline and via USSD, which shields it from power outages and network disruptions. Second, it would promote innovation and competition, with a BNR study finding that a duopoly in the mobile payments sector by MTN and Airtel has driven up transaction costs. A digital franc would provide a cheaper alternative, forcing these telecoms to lower charges and offer better services.

The CBDC would also boost Rwanda’s journey toward a cashless economy and enable faster and cheaper remittances.

Local innovators have supported the CBDC project but called on the top bank to focus on making it accessible through USSD codes and offline transactions.

“Retail use of the CBDC should be the focus to be able to bring in as many users as possible. This helps to learn fast and iterate on what works and what doesn’t,” commented Bobson Rugambwa, the CEO of local fintech Mvend.

Botswana conducts CBDC feasibility study

In Botswana, the government is conducting a feasibility study to determine if it should develop a CBDC.

Ruth Baitshepi, who heads the innovation hub at the Bank of Botswana, recently revealed that the bank is in the early stages of its CBDC journey.

“First and foremost, we want to determine if there is even a need for a CBDC in Botswana and whether the emergence of digital assets poses any threat to the sovereignty of the Pula to necessitate a CBDC,” she said during a media briefing, local outlets report.

Botswana is home to 2.5 million citizens, despite being among the 50 largest countries by land area, making it one of the most sparsely populated nations globally. In the past five years, mobile payments have spiked, boosting financial inclusion. However, one in three Batswana remains unbanked.

Watch: Finding ways to use CBDC outside of digital currencies

02-21-2026

02-21-2026