|

Getting your Trinity Audio player ready...

|

Nigerian banks must adopt digital assets and blockchain to stay competitive, but must manage the exposure as risks abound, global consulting giant KPMG says in its latest report.

The report, published in partnership with Chainalysis, broke down Nigeria’s digital asset adoption over the past four years, the opportunities it has presented to the West African nation, and the risks prevalent in the rapidly growing sector.

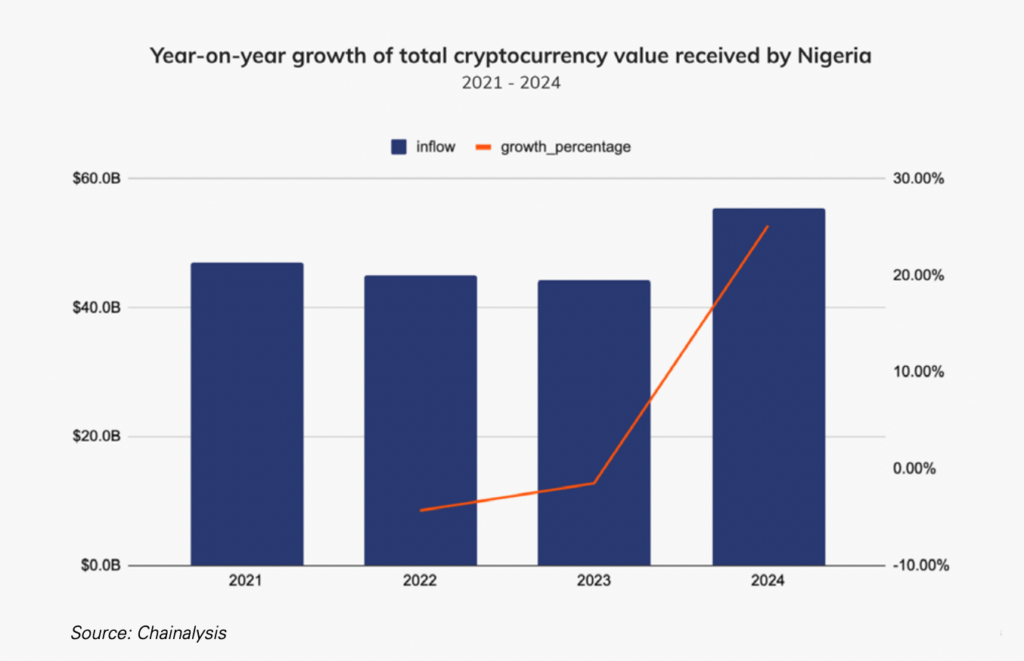

According to the report, the total digital asset value received by Nigerians rebounded last year, surging 25% year-over-year after three years of consecutive dips. Of the $125 billion Sub-Sahara Africa received in the year ending June 2024, Nigeria’s $59 billion accounted for nearly 50%.

For Nigerians, digital assets aren’t ‘digital gold’ or speculative assets for overnight riches. The report notes that 85% of the total value received was in small denominations, linked to retail traders who used digital assets to move value across borders.

And yet, despite the clear adoption trends, Nigerian banks are still reluctant to adopt digital assets or work with VASPs. This apprehension isn’t unfounded: the Central Bank of Nigeria (CBN) has been anti-BTC for years, issuing two circulars prohibiting banks from involvement in the sector. In 2022, CBN hit six banks with a N1.31 billion ($3.155 million) fine for servicing customers dealing in digital assets.

However, a lot has changed since then and the Nigerian government, under President Bola Tinubu, has been more welcoming of the sector. Last year, it issued the first two VASP licenses to local exchanges Busha and Quidax.

“The question, therefore, is not about whether or not banks should engage with crypto, but rather it is about how they should manage their crypto exposure, while leveraging the opportunities therein,” KPMG says.

However, banks must be aware of the unique risks that digital assets pose, which their existing risk monitoring frameworks are ill-equipped to handle.

“Pseudonymity, the speed of on-chain transactions, and the use of intermediaries with varying degrees of regulatory oversight make conventional risk assessment and monitoring inadequate,” the report noted.

However, blockchain also offers advanced capabilities for banks to manage risks and monitor transactions, it added. Its immutability and transparency provide real-time visibility into the flow of funds, a dynamic that doesn’t exist in legacy finance today.

Nigerian banks that integrate blockchain “enhance their ability to detect illicit finance, expand into new financial services, and position themselves at the forefront of an increasingly digital financial system.”

Meanwhile, Nigeria’s lawsuit against Binance for tax evasion and lax oversight continues. This week, a local outlet revealed that the exchange offered to pay $5 million as a down payment for its tax obligations last year to secure the release of the then-detained official Tigran Gambaryan. He has since been released following a deal between the Nigerian and American governments.

Watch: Blockchain is changing Nigeria’s tech city ecosystem

03-04-2026

03-04-2026