|

Getting your Trinity Audio player ready...

|

There isn’t a strong case for issuing a retail central bank digital currency (CBDC) in Namibia, and the central bank should focus on promoting existing payment improvements, the International Monetary Fund (IMF) says.

A mission from the IMF was in Namibia in January, and in a recent report, it advised against pursuing a sovereign digital currency for retail consumers.

“As the mission did not find a strong support for rCBDC issuance to address gaps in payments, it recommends against pursuing advanced technological exploration beyond proof-of-concept until tangible benefits of CBDC for payments are evident,” the report says.

The Bank of Namibia (BoN) has been exploring a digital Namibian dollar for the past three years. In 2022, it revealed that it was conducting research on whether a CBDC could improve the country’s digital payments landscape and promote financial inclusion. It has also partnered with other members of the Common Monetary Area—which includes South Africa and Swaziland—to explore a cross-border CBDC.

However, according to the IMF, Namibia should focus on improving existing local solutions.

“Instead of developing a novel payment infrastructure such as rCBDC, the BoN could consider alternative solutions such as supporting measures or regulations to enhance financial inclusion,” it stated.

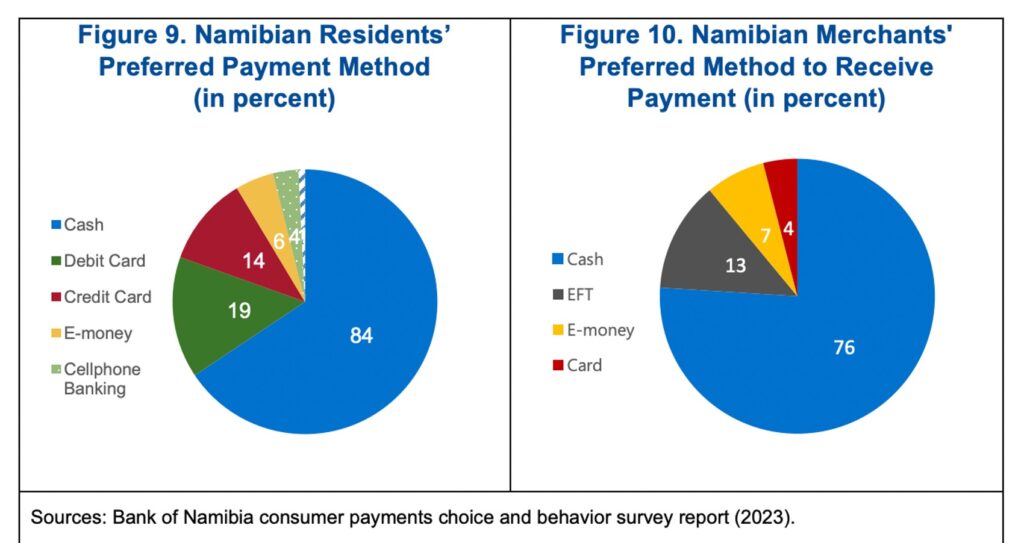

Namibia is home to 3 million people, making it one of the smallest African nations. It has lagged behind other Southern African countries in digitalization over the years. A 2023 study by the BoN found that cash remains the most preferred payment method.

The IMF says that the central bank should focus on creating an enabling environment for companies addressing this gap “by offering incentives and alleviating regulatory burdens.” Additionally, it should launch education and awareness campaigns to ensure consumers are well-informed about the available products and services and their rights in the digital space.

“rCBDC may have potential to address some of the challenges but does not offer a unique value proposition to address financial exclusion issues at this juncture. Also, rCBDC alone would not be able to address underlying issues such as constraints within digital infrastructure and deficiencies in financial literacy.”

Namibia should continue exploring CBDCs, but not for immediate launch, the IMF added. The top bank should investigate the effect that a digital dollar would have on monetary policy and financial stability and challenges that would impede adoption, such as poor digital infrastructure.

Nigeria remains the only African nation to launch a CBDC. The eNaira, however, was a flop, with Nigerians either distrusting the new digital currency or opting for the existing digital payment methods. A recently launched stablecoin in the West African nation hopes to succeed where the eNaira failed.

Watch: Boosting financial inclusion in Africa with BSV blockchain

03-07-2026

03-07-2026