|

Getting your Trinity Audio player ready...

|

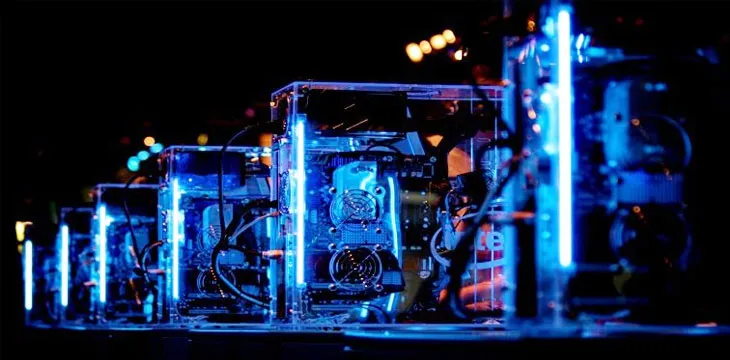

Last Friday, HashFlare announced via a Facebook post that it was halting its cryptocurrency mining operations and also pulling the plug on hardware involved in SHA-256 contracts over a lack of money. The cloud mining company said that the operations weren’t producing enough income and comes during an extended downturn in the cryptocurrency markets.

HashFlare first began operating its cloud mining platform in 2013. The system allows a user to purchase a piece of the mining power of hardware that is owned and hosted by a cloud mining service provider. That provider is responsible for maintaining the network, including hardware configurations, uptimes, and pool selection.

According to the company, it hasn’t been able to turn a profit due to the current market situation. HashFlare explained that there have been zero accruals to users’ balances for more than a month due to contract payments being lower than the collected service fees. The company said, “We have made every possible effort in order to resolve the problem that has arisen—for instance, we have considered a variety of technical solutions, which would have allowed us to lower expenses related to maintenance and electricity… As BTC mining continues to be unprofitable, we inform that on July 18, 2018, we had to start disabling SHA equipment, and today, on July 20, 2018, withhold the mining service for active SHA-256 contracts.”

Coincidentally, the news comes only a day after HashFlare informed its users that they are now required to submit themselves to Know Your Customer (KYC) identification verification processes, as well as to anti-money laundering (AML) standards. In making the announcement to its users, the company added that “verified users will enjoy increased daily and monthly withdrawal limits.”

The news comes during a rodeo ride of activity in the cryptocurrency mining equipment industry. Mining rig production has slowed down, due mostly to the current market situation, and doesn’t show any signs of improvement. The Taiwan Semiconductor Manufacturing Co., which makes chips for companies such as Apple, Qualcomm and NVidia, updated its annual revenue forecast at the end of last week, saying that it was forced to reduce expectations because of the market. The growth forecast, which had been set at 10%, was reduced to “a high single digital percent.”

07-04-2025

07-04-2025