|

Getting your Trinity Audio player ready...

|

2024 has been the year when tokenization dominated the headlines. With financial titans like Larry Fink calling Bitcoin and Ethereum “stepping stones toward tokenization” and innumerable stories about central banks, governments, and big firms embracing the tokenization of everything, the concept has finally become mainstream.

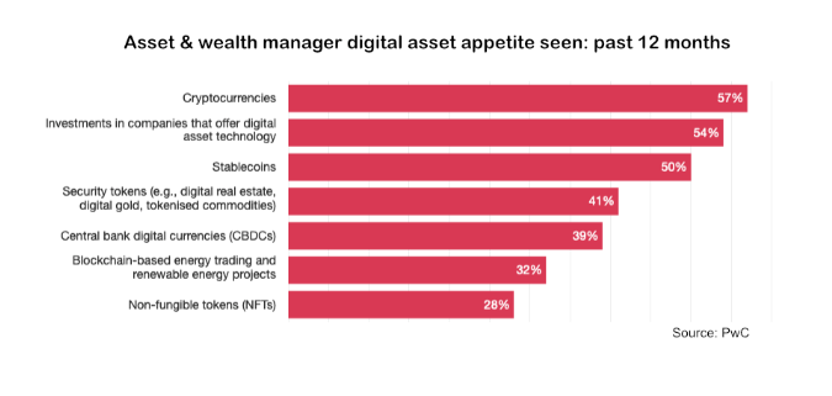

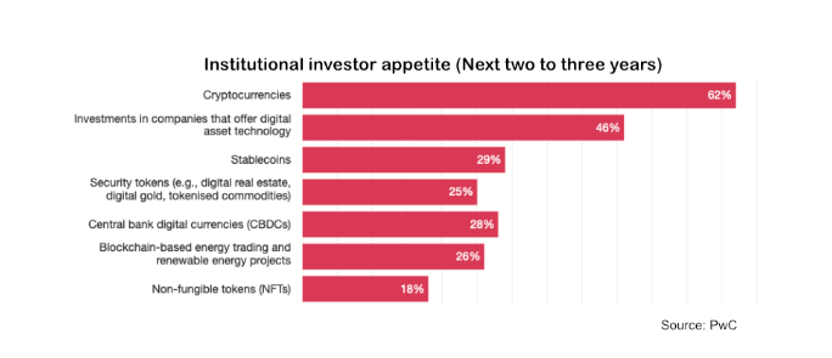

However, a recent survey by PwC showed that tokenized assets were far down the demand list for wealth managers and institutional investors. Digital currencies, investments in companies that offer digital asset technology, and stablecoins were in the highest demand for both, and in that order.

Preparation for another bull run?

Asset and wealth managers said digital currencies (57%), investments in companies in the sector (54%), and stablecoins (50%) had been most in demand in the past 12 months. Institutional investors said these three would be of most interest in the next two to three years.

Are tokenized RWAs taking a back seat to Bitcoin, Ethereum, and stocks in related companies like Coinbase (NASDAQ: COIN) because of the anticipated bull market? That is a reasonable inference; it’s unlikely that tokenized gold or real estate will appreciate by the same margins as popular coins or industry stocks in the next year or two.

Yet, the tokenization of everything hasn’t been forgotten; Asset and Wealth Management (AWM) and institutional investors had it in fourth place. AWMs said 41% of clients had shown interest in ‘security tokens’ (tokenized gold, real estate, and commodities), while institutional investors predicted around a quarter would be interested in the next few years.

While the bull market may draw some attention away from investing in tokenized RWAs, the trend toward tokenization will continue unabated. As always, while the majority are focused on the latest meme coin or the new BTC all-time high, the builders focused on blockchain utility will continue to work in the background.

Need for a globally scalable blockchain

In a recent article, I highlighted Ethereum‘s current state, pointing out how its fragmented jumble of layer two solutions is causing problems. The same holds true for blockchains; many of the technology’s benefits are lost if users have to move across them via bridges, rollups, and other mechanisms.

A scalable blockchain at the base layer is required to create a genuinely transparent financial system where digital currencies, tokenized assets, NFTs, and everything else can be exchanged peer-to-peer. Following the movement of assets between owners requires an unbroken chain of time-stamped records.

Multiple blockchains are akin to numerous books of financial transactions, enabling fraud and lost records to creep back in and schemes and scams to continue. The introduction of thousands of private blockchains complicates matters even further. Likewise, having numerous limited blockchains that can’t handle global transaction volumes is like having many internets that users must move between to use different applications.

A much better alternative to use for tokenizing real world assets is a globally scalable blockchain like BSV. One blockchain capable of handling millions of transactions per second on layer one is a superior solution, allowing all apps to be built on one chain interoperably.

Likewise, tokenized assets and digital currencies can exist on this one chain with time-stamped records showing who owns them, when they moved, and more. Where applicable, these currencies and assets can interact with the applications built on the global blockchain.

While the current bull market will temporarily distract many, those focused on building the future should realize that most of today’s options are dead on arrival. Just as the internet became the global computer network we use, the most scalable blockchain will ultimately win—choose where to build accordingly.

Watch: New age of payment solutions

03-09-2026

03-09-2026