|

Getting your Trinity Audio player ready...

|

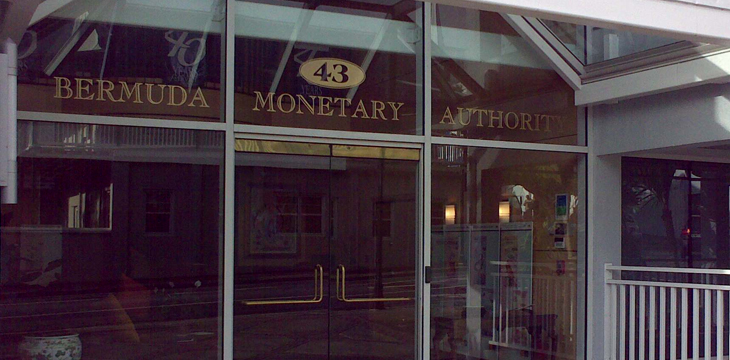

Getting things together before the end of 2018, the Bermuda Monetary Authority (BMA) was able to release (in pdf) draft legislation of its Code of Practice for Digital Asset Custody for rebiew. The draft is designed to offer measures that ensure “a high level of care when safeguarding client’s assets” and is open for public comments until January 18.

The code governs how custodians of digital assets must operate and would be obligatory for any digital asset company that is responsible for maintaining private keys. It provides guidance for both hot and cold storage, the handling of transactions, the generation of key and how to handle incident reports. The draft reads, in part, “Failure to comply with provisions set out in the Code will be taken into account by the Authority in determining whether a licensed DAB is meeting its obligation to conduct its business in a sound and prudent manner in accordance with the Act.”

This past September, the BMA released its requirements for businesses to acquire licenses for crypto operations in the country. The Caribbean island nation is looking to become a major hub for crypto and blockchain operations and has even made changes to its Banking Act to allow FinTech companies to feel confident about operating in the country.

Bermudan banks had stopped working with companies in the blockchain industry offer regulatory concerns. They were afraid, in absence of any governmental policies in place, that they could potentially be running afoul of the law. As a result, a number of FinTech companies moved out of the country in search of crypto-friendly jurisdictions and the updates to the Banking Act provided the support needed to bring them back.

The new code will be an extension of the rules already set in place by authorities. The BMA’s Senior Advisor of Financial Technology, Moad Fahmi, asserts, “We remind stakeholders that the framework was built with the aim of making sure that the core objectives of financial regulation are respected, that is: protecting consumers, ensuring stability of our institutions and maintaining integrity and confidence in financial markets – with a focus on maintaining the highest standards of [anti-money laundering/anti-terrorism financing].”

The Managing Director of Supervision (Insurance) for the BMA, Craig Swan, added, “This technical publication highlights the quality of the work done by our team at the BMA to build on our cybersecurity acumen as we move to become regulatory leaders in digital assets. It is aligned with the BMA’s 2018 Business Plan objectives of being proactive, comprehensive and forward-looking.”

02-23-2026

02-23-2026