|

Getting your Trinity Audio player ready...

|

Australians made over 4 billion mobile payment transactions in 2024, totaling over $100 billion, a new industry report has revealed.

The 2025 Bank On It report by the Australian Banking Association (ABA) revealed that the digital revolution continues to reshape the country’s banking sector, with cash withdrawals and branch visits steeply declining.

In 2024, 99.3% of all customer interactions with the banks were digital, a slight increase from 99.1% the year prior. Satisfaction with these digital banking channels also remains exceptionally high, ABA CEO Anna Bligh noted.

“Australians consistently express greater satisfaction with their digital banking experiences compared to international peers. Banks’ sustained investment in secure, intuitive platforms continues to translate into world-leading user satisfaction,” she stated.

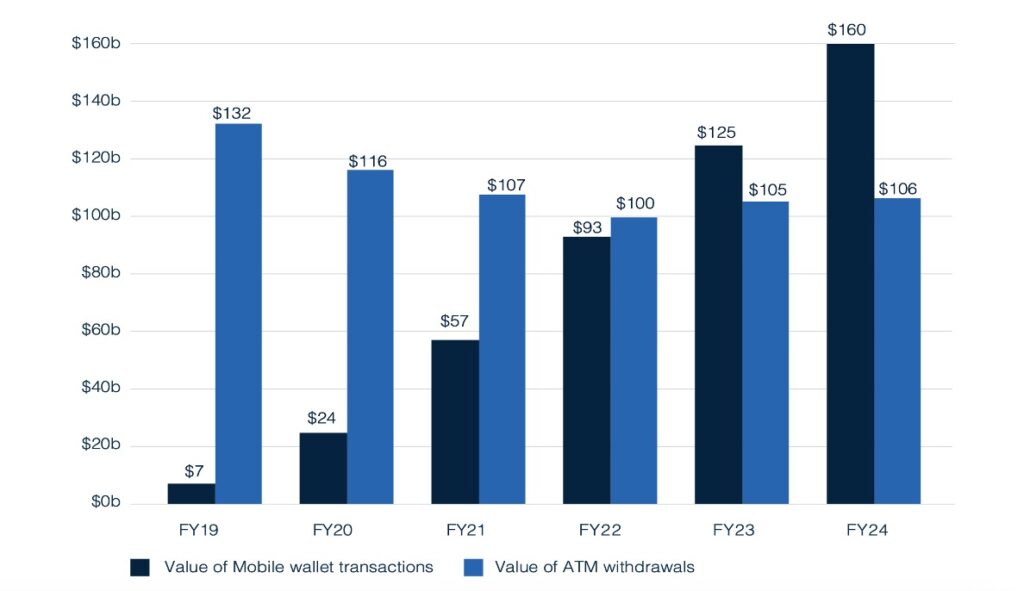

The most dominant channel was mobile banking. The report revealed that Australians made over 4 billion transactions in 2024, worth over AUD160 billion ($105 billion), from their mobile wallets, a 28% increase year-over-year. This represents a 2,300% surge since 2019; mobile wallet transactions are now 11x that of cash ATM withdrawals.

The decline in customer visits to physical bank branches comes despite Australia’s widespread branch access. The country has a commercial bank branch density of 17 branches for every 100,000 adults, higher than OECD peers with similar urbanization levels, such as Finland and New Zealand.

Australians are also more satisfied with their banking channels than their peers from other OECD countries. Digital apps, for instance, have a 66% satisfaction rate, compared to 60% in other countries.

The shift to digital has also boosted the country’s financial inclusion rate. Australia now ranks third among G20 economies for ownership of bank accounts by citizens aged 15 and above, sitting behind the U.K. and Canada, respectively. It also ranks 23% above the global average for account access.

Australia’s digital banking hasn’t been without its challenges. Neobanks in the country have struggled to compete with legacy giants, unlike in other major economies like the U.K., where they have been a massive success. The country’s first neobank, Volt, shut down in 2022, just three years after launch, after failing to raise sufficient capital.Even mobile wallets, whose user numbers have been skyrocketing in recent years, raise fresh concerns for regulators. In February, the ABA called on lawmakers to amend payment laws to tighten regulations for mobile wallet operators. She claimed that the lax oversight gave mobile wallets an unfair advantage over their legacy banking rivals.

Australia’s digital evolution has also seen a rise in tokenization. The most prominent effort is being led by the central bank under Project Acacia, which launched last November. It seeks to test applications such as stablecoins, central bank digital currency (CBDC), and bank deposit tokens.

Ethiopia to roll out first domestic credit card

Elsewhere, Ethiopia is set to launch the first credit card developed in the country in a giant leap towards a cashless future.

The new card was developed by SanuPay, a UAE-based fintech startup with a growing presence in East Africa, in partnership with global digital payments firm OpenWay. SanuPay plans to issue at least 4 million debit and credit cards to Ethiopians. The firm will issue the first batch to Addis Ababa-based private lender Oromia Bank customers.

“We have selected the best-in-class solution to provide best-in-class payment services in Ethiopia…SanuPay is enabling a new era of card issuing in Ethiopia and beyond—building resilient, scalable, and compliant infrastructure that supports Africa’s digital financial transformation,” CEO Alfred Gachaga commented.

Card payments in Sub-Saharan Africa remain the lowest globally at 18% and 3% for debit and credit cards, respectively. Experts have blamed the low uptake on infrastructural limitations and prohibitive regulations. In contrast, mobile money adoption is among the highest globally.

“Ethiopia is not only launching its first domestic credit card but is laying the foundation for a modern, inclusive, and interoperable payments landscape,” commented Hermann Mike, OpenWay’s regional director for Africa.

While the new domestic cards will advance Ethiopia’s financial inclusion, mobile money remains the market leader in digital payments. The government’s aggressive push since 2020 has seen the country enroll 41 million mobile banking users in the past four years alone.

Watch: New age of payment solutions

02-28-2026

02-28-2026