|

Getting your Trinity Audio player ready...

|

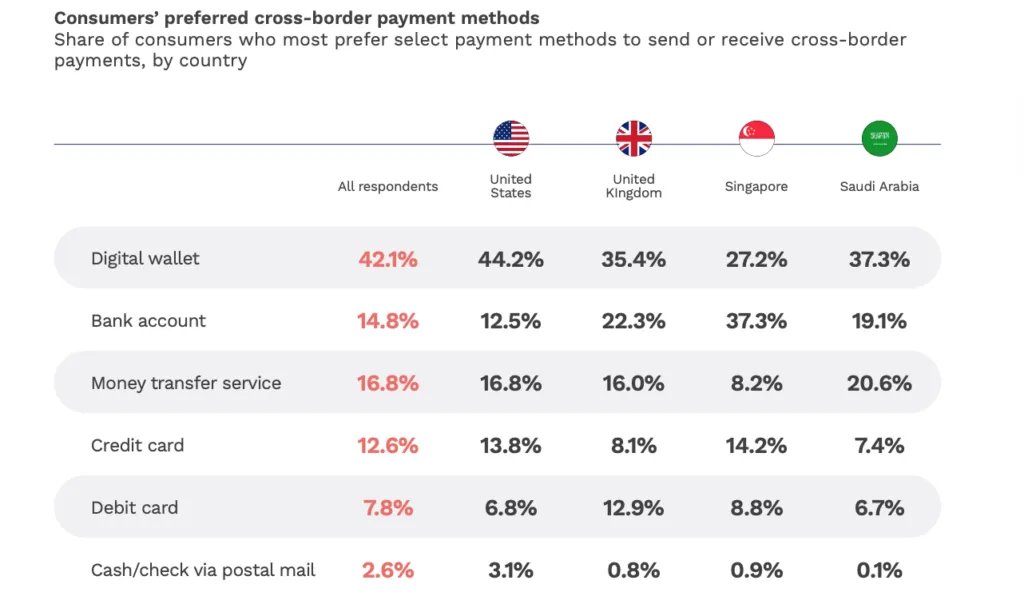

Digital wallets are the most popular platform for cross-border transactions, accounting for twice as many respondents as the next best option, a new report has revealed.

A survey conducted by PYMNTS and TerraPay found that consumers are 2.5 times more likely to select digital wallets as their top choice for cross-border transactions than money transfer services and bank accounts, respectively. Overall, 4 in 10 consumers prefer digital wallets, with the U.S. leading at 44%.

Of the surveyed nations, Singapore was the outlier, with 37% selecting bank accounts while 27% chose digital wallets.

Cross-border payments are a gigantic industry. One report found that, in 2024, non-wholesale payments hit $40 trillion, with B2B payments accounting for the lion’s share. Consumer-to-consumer payments hit $2 trillion and are expected to grow by 58% by 2032 to hit $3.1 trillion.

However, the market still suffers from slow, costly and inaccessible channels, especially for consumers in developing nations.

While consumers lamented all these hurdles, speed was the most oft-cited challenge. This has pushed more consumers to explore digital wallets, which are faster than traditional channels. 16% of respondents cited “payments are faster” as the main reason they chose digital wallets, with ease of use, reliability and wide acceptance each getting 10%.

This need for speed is a universal demand, including in the blockchain world. Networks like BTC and Ethereum, still trapped in the pre-adoption era where a handful of transactions per second were good enough, have been a primary hindrance to mainstream blockchain adoption. BSV, on the other hand, continues to scale, and with the Teranode upgrade, the network will meet the ever-rising demands in payments, artificial intelligence (AI), social media and beyond.

The report further highlighted the ongoing battle between traditional finance and fintechs in cross-border payments. It found that in the U.S., only 49% of banks allow consumers to send and receive cross-border payments via digital wallets. However, 98% enable bank account transfers. It’s similar in the U.K., where only 58% of the banks support digital wallet transfers while 92% support same-day ACH.

The most cited challenge by banks was that digital wallets are “too complicated to use,” with high costs and poor security as the other common challenges.

Watch: RockWallet is the go-to app for everyone

08-25-2025

08-25-2025