|

Getting your Trinity Audio player ready...

|

Days before Donald Trump was inaugurated as the 47th President of the United States, digital currency traders learned via an X post that the President-elect had launched an official $TRUMP memecoin on Solana.

Initially wondering if the Trump account had been hacked, traders soon realized it was real, causing a stampede to “decentralized” exchanges like Raydium while centralized exchanges like Coinbase (NASDAQ: COIN) scrambled to list the Trump token.

What followed was nothing short of a debacle. Leaving aside questions of ethics and securities regulations, the race to snap the President’s official coin up drove prices sky-high and brought the Solana network to a standstill. It’s not the first time that has happened.

While the Solana blockchain officially “stayed up” and didn’t go offline for a hard reset like it has before, buying and trading $TRUMP was a less than impressive user experience. Yet, the mania had just begun because the very next day, the First Lady launched her own token, $MELANIA, causing another pile-on as traders scrambled to buy it before the pump began.

The industry still hasn’t accepted that it’s all about the original Bitcoin protocol

If you look at the “Top 20” tokens on any site like CoinMarketCap.com, you’ll find tokens with market caps worth tens of billions, yet none of the blockchains can handle an influx of millions of users, let alone billions. Imagine how they’d cope if a popular game or app went viral globally.

Yet, outside the limelight, some blockchains scale. The BSV blockchain has successfully scaled to one million transactions per second thanks to its Teranode update. Blockchains like this take a lot of flack for supposed “spam” transactions, with critics claiming they aren’t genuine and are controlled by bots, but moments like this show that it doesn’t matter, even if it were true (it’s not).

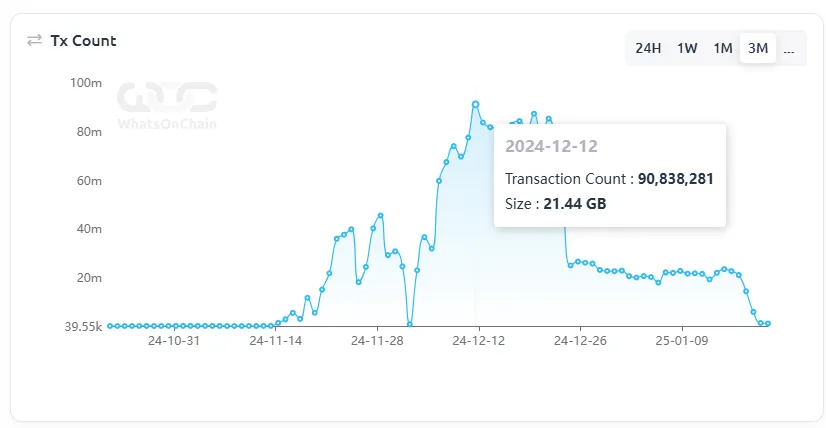

A transaction is a transaction, whether sent by a human or a bot. What matters is that the blockchains in question can handle the demand reliably without a dramatic fee spike. In BSV’s case, it has proven it can handle 90 million daily transactions without a hiccup. Yet, after Teranode goes live, it can handle that volume in 90 seconds flat. Stress testing is important, and BSV has passed with flying colors.

Critics can point to some of the drama surrounding BSV and the characters involved in it over the years, but they can’t lay a glove on it when it comes to technical capabilities. When push comes to shove, BSV delivers, and the more popular blockchains buckle under pressure repeatedly.

Interesting insight: The Visa (NASDAQ: V) network processed 192.5 billion transactions in 2022. With the Teranode upgrade enabling one million transactions per second, the BSV blockchain could process the entire Visa network volume for that year in just over 53 hours.

It’s time to embrace solutions that work

At some point, blockchain entrepreneurs and developers must set tribalism aside and embrace technology that works. Users won’t tolerate ledgers that fold or fees that spike during an influx of users for long. Should something go viral that appeals to regular people who don’t use blockchain regularly, the technology had better be ready.

With the increased attention from institutions, governments, and financial giants embracing tokenization, central bank digital currencies (CBDCs), and other blockchain solutions, performance matters. While memecoins may steal the spotlight in the short term, technology that works will win the long game.

Watch: History of Bitcoin with Kurt Wuckert Jr.

08-16-2025

08-16-2025