|

Getting your Trinity Audio player ready...

|

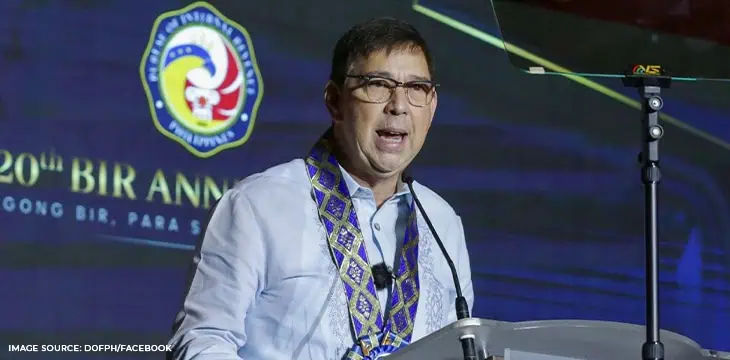

The Philippines’ Department of Finance (DOF) Secretary Ralph Recto has underscored the critical role of the Bureau of Internal Revenue (BIR) in ensuring the government meets its fiscal targets, emphasizing that sustained improvements in revenue collection are essential for economic growth and national development. Speaking at the BIR’s 120th anniversary earlier this month, Recto highlighted the importance of digitalization in achieving these goals.

“For the truth is, when fiscal targets are not met, it is the people who pay for such failure,” Recto stated in his keynote speech. “Projects that would improve their lot today are denied of funding, creating a pile-up of debts that will be paid by our children tomorrow.”

Recto stressed that consistent revenue improvement directly translates into meeting the needs of the people, enabling investments that spur economic growth, create jobs, and ultimately enhance citizens’ ability to pay taxes. He called this a “virtuous cycle” that the government must champion.

BIR’s new digital initiatives: A step forward

During the anniversary event, the BIR unveiled its new logo and a revamped Web portal, both of which signify the agency’s commitment to modernization. The new logo, featuring the Philippine Eagle, three stars, a sun wreath, and the colors of the Philippine flag, symbolizes the BIR’s renewed focus on national pride and service.

The new BIR Web portal, developed in collaboration with the Department of Information and Communications Technology (DICT), aims to strike a balance between convenience and professionalism. BIR Commissioner Romeo Lumagui Jr. highlighted that the portal provides easy access to tax information, updates, and eServices, reflecting the BIR’s commitment to modernizing its operations in the 21st century.

Recto reiterated his call for the BIR to leverage digitalization to make paying taxes easier for citizens. He pointed to the BIR’s Digital Roadmap for 2024-2028 as a crucial guide in achieving this goal.

“I am sticking to my guns that more revenues can be raised by simplifying, shortening, streamlining, and speeding up the process, without leaving the government shortchanged, than a slew of higher, newer tax laws,” Recto asserted.

Digitalization as a tool for efficient tax administration

Recto emphasized that digitalization should be seen as a “liberation technology” that simplifies tax payment processes. He warned that complex payment systems, whether digital or manual, can deter taxpayers from complying, thus hindering revenue collection.

The DOF secretary urged the BIR to continue its digitalization efforts by implementing systems such as the Online Registration Update System, the Optimized Knowledge Management for Chatbot Review, and the Electronic One-Time Transaction System. These initiatives, Recto said, are essential to proving the agency’s capabilities in information and communications technology (ICT) infrastructure.

“Siguraduhin po natin na integrated at konektado ang mga ito para sa walang tigil na serbisyo sa ating mga taxpayers at sa mas mabisang pangagasiwa ng buwis (We will make sure they are integrated and connected for seamless service to our taxpayers and more effective tax administration),” Recto said, emphasizing the need for an integrated and connected approach to tax administration.

Collaboration and data-sharing: Keys to plugging tax loopholes

Recto also highlighted the importance of stronger coordination between government agencies through data-sharing. He pointed to the recently established Swift Corporate and Other Records Exchange (SCORE) Protocol, a pilot project between the Securities and Exchange Commission (SEC) and the BIR. This initiative allows for the swift sharing of data and empowers the BIR to harmonize records of registered corporations, thereby enhancing tax collection efficiency.

Recto affirmed that such partnerships are crucial for the successful implementation of new tax laws, including the proposed value-added tax (VAT) on digital services. He tasked the BIR with the ambitious goal of collecting PHP3.05 trillion ($53.2 billion) this year, which translates to a daily collection of PHP8.2 billion ($143 million) or PHP342.5 million ($5.9 million) per hour.

“Today, 75% of government revenues that end up in pay envelopes of the government workers is collected by you,” Recto told the BIR employees. He highlighted the BIR’s critical role in financing government activities, from building roads to purchasing medicines and constructing classrooms.

Recto also stressed that without the revenues collected by the BIR, government rhetoric would not translate into reality, and promises would not become projects. He warned that if the BIR fails to meet its targets, not just the government but the people will suffer.

The path forward: Sustaining success through innovation

Recto expressed confidence in the BIR’s ability to meet its collection targets, not only for this year but for many years to come. He acknowledged the challenges that lie ahead, particularly in implementing new tax laws and ensuring compliance. Still, he remained optimistic that with continuous training, technological upgrades, and welfare measures, the BIR would succeed.

“Kaya ang masasabi ko, patuloy lang, pero sa isang paraan na may respeto sa taumbayan at may pag-galang sa batas (So what I can say is, just keep going, but in a way that respects the people and respects the law),” Recto advised.

Watch: The Philippines is moving toward blockchain-enabled tech

09-15-2025

09-15-2025