|

Getting your Trinity Audio player ready...

|

- Zumo releases Digital Assets 2023: Identifying the opportunities across the enterprise landscape at Sibos 2023 in Toronto.

- The unique insights report is the first to comprehensively survey and analyse the emerging areas of opportunity within the global digital asset ecosystem from a non-crypto-native ‘enterprise’ perspective.

- The in-depth report features a host of expert contributions from some of the world’s leading financial institutions and digital asset pioneers.

[Edinburgh/Toronto, Tuesday 19 September 2023] – Zumo, the B2B digital assets infrastructure, has launched a ground-breaking new report at Sibos 2023 in Toronto.

The report, titled Digital Assets 2023: Identifying the opportunities across the enterprise landscape, is the first to comprehensively survey, categorise and practically analyse emerging areas of opportunity across the global digital asset ecosystem from an enterprise perspective.

Digital Assets 2023 draws on fresh insights from the biggest names across the digital asset and financial services industries to highlight the opportunities in the nascent sector. Contributors include financial services giants – such as HSBC, NatWest, and Visa – and noted blockchain innovators, including Ripple and Chainalysis.

Industry cooperative, and Sibos organiser, Swift is another key contributor, with the organisation busy collaborating with its global community to test how financial institutions can interoperate with the multitude of blockchain networks emerging around the world.

A new ecosystem for a new age

Digital Assets 2023 traces the evolution of blockchain from an enterprise perspective, identifying four turning points characteristic of a progressive broadening in digital asset applications and participants, from the Bitcoin big bang moment (‘blockchain 1.0’) through to the first ‘enterprise’ era (‘blockchain 4.0’).

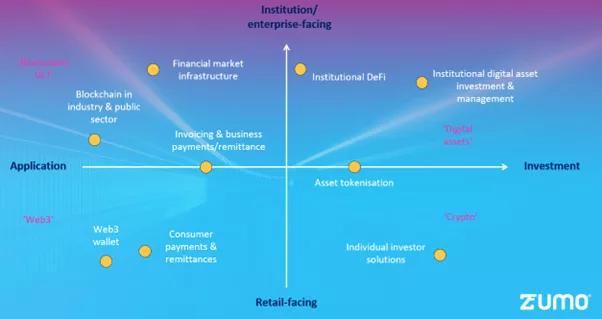

The report uses this context to construct an enterprise ecosystem map distinguishing consumer and institutionally-facing solutions, and investment versus applied use cases.

It then assesses the opportunities, challenges and inter-relationships associated with nine individual use cases, categorised as early (institutional digital asset investment; institutional DeFi; web3); developing (tokenisation; blockchain in industry; DLT for financial market infrastructure) and established (consumer-facing cryptoasset investment; and individual/business blockchain payments).

Daniel Taylor, Zumo’s Research and Policy Lead, and the report’s author, said:

“Active learning and knowledge development is a key part of Zumo’s mission as a trusted partner for those looking to enter the digital asset space.”

“Today is the first truly ‘enterprise’ era, in which non-crypto businesses have access to, and are active across, all four quadrants of digital asset opportunity: consumer, institutional, application and investment. Our report practically distils and synthesises those emerging opportunities based on a big-picture understanding of the digital asset and blockchain ecosystem.”

“Digital Assets 2023 has been brought to life through consultation and cross-sector collaboration, and Sibos, with its emphasis on networking and learning, is therefore the perfect platform for launching it.”

Digital Assets 2023 is free to download at: https://zumo.tech/digital-assets-2023/

The enterprise ecosystem map

Summary findings from the report

- On consumer-facing investment solutions (chapter 1), consumer entry routes into cryptoasset investment have diversified significantly, with a timeline of increasing participation from institutions and wealth managers.

- On consumer payments (chapter 2), cryptoassets and stablecoins for payments represent one of the most proven areas of utility, but increasingly compete with emerging tokenised deposit and central bank digital currency (CBDC) explorations (which currently remain significantly behind in adoption).

- On web3 (chapter 3), brands continue to embrace web3 opportunities and are now actively generating royalties and revenues.

- On tokenisation (chapter 4), there is an emerging cluster of renewed activity and active project development around tokenisation of existing financial asset classes.

- On business payments (chapter 5), businesses continue to explore digital asset payment rails for treasury and cross-border payments, with a willingness to embrace CBDC payment methods in the future.

- On blockchain in industry (chapter 6), current development is led by financial market infrastructure and public sector narratives, together with an active strand of interest in blockchain applied to energy and the environment.

- On financial market infrastructure (chapter 7), there is an ongoing diversity of efficiency-focused initiatives that includes some of the largest active DLT projects.

- On institutional asset investment and management (chapter 8), there is increasing institutional digital asset investment engagement on both buy and sell sides, with increasingly institutionally-driven trading markets.

- On Institutional DeFi (chapter 9), there is an openness to integrate and engage with DeFi concepts in an institutional setting, including an uptake in institutional staking and pilot applied CBDC + tokenisation projects.

About Zumo

Zumo believes everyone should have access to sustainable finance, and that blockchain has the power to deliver this globally. Its mission is to provide a better planet for digital assets, delivering sustainable, accessible and secure ways to unlock the benefits of web3.

As an enterprise-focused digital-asset-as-a-service platform, Zumo’s turnkey, API-based infrastructure offers a fast, flexible and compliance-sensitive route to market, empowering fintechs, banks, asset managers and brands to offer their clients the tools of the future simply, securely and sustainably while also opening up new revenue streams, attracting new customers and supporting customer retention.

A values-driven business, Zumo has underlined its commitment to a fairer society and a sustainable planet with an ambitious 2030 net zero strategy encompassing its own business; the blockchains it works with; and the wider digital asset ecosystem. Carbon-neutral since inception, the business is committed to ongoing collaboration in the decarbonisation of the digital assets industry. Zumo was an early signatory of the Crypto Climate Accord, the first digital asset business to receive U.K. government funding from the U.K.’s national innovation agency, Innovate U.K., to further its applied work on the decarbonisation of digital assets, and is now a key contributor to industry guidance on the energy consumption of blockchain, working in tandem with the World Economic Forum and the OECD.

Zumo’s infrastructure also powers the direct-to-consumer Zumo App, launched in the U.K. and registered with the Financial Conduct Authority (FCA).

07-31-2025

07-31-2025