|

Getting your Trinity Audio player ready...

|

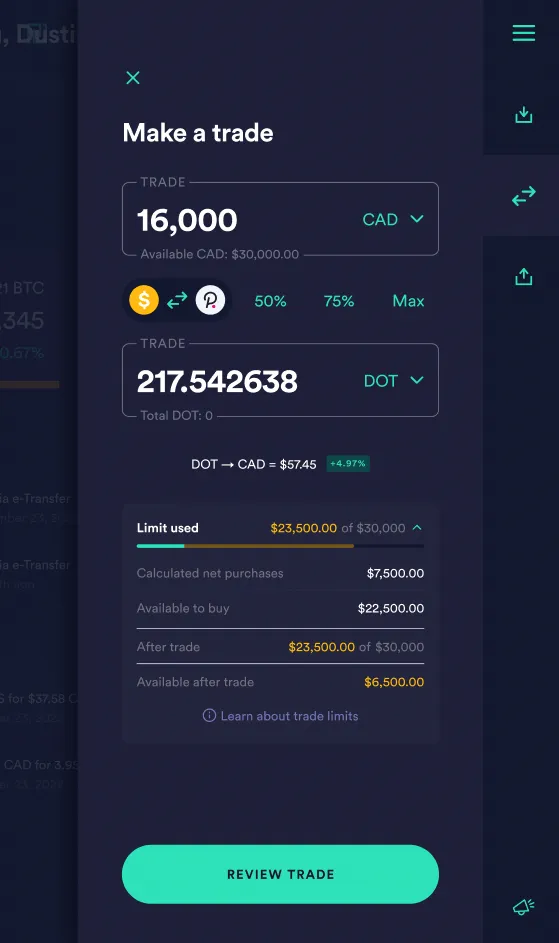

A Canadian exchange is limiting how much money its users can invest in digital assets in a move it says is meant to protect investors. Newton has imposed a C$30,000 (U.S.$23,300) limit on digital asset purchases annually, a move that many have criticized.

This week, Newton announced three changes to its operations as it seeks to comply with regulators. One requires users to fill out a questionnaire that gives the exchange a better view of their risk tolerance, while the other reveals that users will be getting notifications if their portfolios approach a loss level beyond which they aren’t comfortable with.

It’s the third change that most have expressed concern about. This change imposes annual net purchase limits on users to $23,300, with the limit resetting after 12 months. Users from Alberta, British Columbia, Quebec, and Manitoba will not be affected. Newton said BTC, ETH, Litecoin and BCH are exempted from the purchase limit.

“These limits have been put in place by the Ontario Securities Commission (OSC) and the Canadian Securities Administrators (CSA),” the exchange added.

The announcement comes just days since Newton announced that it had secured registration with the OSC and all other securities regulators in Canadian provinces. With over 100,000 users, it’s one of the largest exchanges in Canada.

We’re excited to finally announce our registration with the Ontario Securities Commission (OSC) and the securities regulatory authorities in all Canadian provinces, Yukon, and Northwest Territories. pic.twitter.com/8zx8UJy2DE

— Newton (@newton_crypto) August 16, 2022

Newton isn’t the only exchange to announce purchase limits. Three months ago, Bitbuy reported a similar limitation on all digital assets aside from BTC, BCH, LTC, and ETH. However, it has a higher limit for eligible investors at $77,400, with accredited investors not being limited in their purchases.

The new limits have come under criticism from many, including Ethereum founder Vitalik Buterin (although he couldn’t resist throwing a dig at XRP while at it).

Glad to see Ethereum people pushing against regulations that privilege ETH over other legitimate cryptocurrencies.

(I have not dug into the details of what specifically is going on and to what extent it's a gov thing vs a compliance decision of one business, but either way…) https://t.co/NDYPh5rqsk

— vitalik.eth (@VitalikButerin) August 17, 2022

Canada is not the first country to seek limits for digital asset purchases. Russia attempted to impose a limit on non-accredited investors in 2021, with legislators saying that the larger financial system was being threatened with billions of dollars flowing into digital assets.

Hong Kong had set a precedent earlier last year, proposing that digital asset investment be reserved only for professional investors. In Hong Kong, a professional investor must have at least HK$8 million (U.S.$1.02 million) in his portfolio.

Watch: The BSV Global Blockchain Convention panel, The Future of Digital Asset Exchanges & Investment

https://www.youtube.com/watch?v=AsD1na3VgxE

08-16-2025

08-16-2025