This is a long guide attempting to outline as much information as possible on scams in the blockchain sphere. And it’s probably still not enough.

Ironically, while one of the core benefits of the blockchain is fraud prevention, it has unintentionally given rise to a new age of scams. This is no fault of the technology. Scammers are, after all, experts at taking advantage of anything new—they thrive by exploiting new technology and products, and preying on people who are not familiar with them.

To fight this, we are outlining some of the known scams in the blockchain sphere. A lot of these are actually old scams reengineered to keep up with technology.

The crypto-phishing scam

This is similar to old school phishing scams sent through email, where a hacker sends you a message saying you need to update your password or that some other immediate action is necessary for your online bank account. It usually comes with a threat saying your account will be deactivated or your funds will be frozen, something in that tone. It would then require you to log in to your account through a link that is actually a fake copy of a legitimate website. Once you input your log in credentials, voila! The scammer has your password.

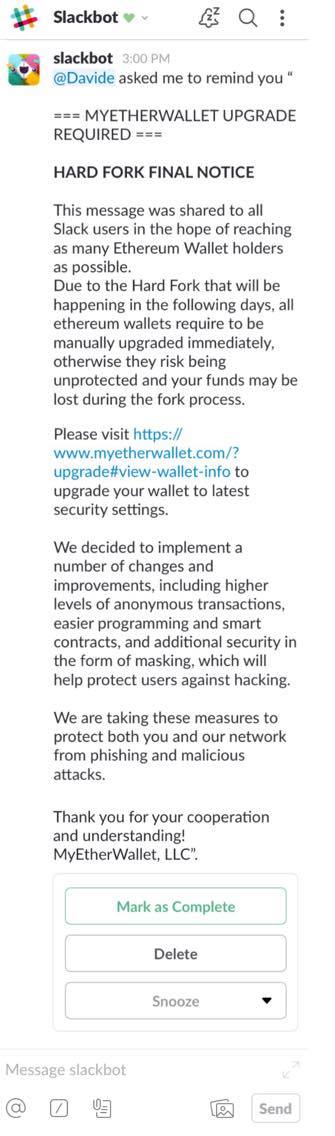

For cryptocoin phishing, scammers usually go through Slack channels, a common chat application frequented by blockchain organizations and cryptocoin enthusiasts. What the scammer does is post something like this:

The scammer uses a legitimate website as a front, in this case, MyEtherWallet. If you’re not familiar with Slack, Slackbot is actually a Slack team’s official “helper,” so scammers exploit the fact that users somewhat trust announcements made by Slackbot. But as it became more prevalent, people have become familiar with it and recognize it at first glance.

The link in this message takes you to a fake website impersonating MyEtherWallet, usually with a URL that closely resembles the legitimate one. Check URL’s closely. Sometimes a simple tweak such as using a capital I to be confused as an L would be enough to confuse you. An example is writing paypaI.com—the scammer used a capital i posing as an L (paypal.com).

If you unwittingly log in to this fake website, the scammer obtains your log in credentials.

Pyramid scheme, disguised as multi-level marketing

If an “investment” relies heavily on people recruiting more people, then let’s call it what it is: a pyramid scheme. It doesn’t matter what products are involved, or what coins they are using as a front, I repeat: they are a pyramid scheme. You probably will make a bit of money here for a time. But let’s not neglect the fact that the reason you earned money is because you lured more people into chipping in for it.

If you have seen the horror movie titled “The Ring,” it’s a little bit like that. In the movie, whoever watches the movie must find someone else to pass it on to. The last person who watches it and does not pass it on will be killed by the ghost. So as a person who just saw it, it’s in your best interest to make sure you recruit someone else to stay alive. This is how it ends for the pyramid. The last person who ponied up for the membership fee and was not able to recruit someone else, loses his money. He didn’t die, but his friendship with his recruiter will.

“Multi-level marketing”or MLM is a term often intentionally misused by organizations who are trying to disguise their pyramid scheme. A legitimate multi-level marketing strategy revolves around sales of products—not in recruiting more members. Distributors recruit other distributors and get percentage commissions off their sales as an incentive.

In pyramid schemes, however, recruits are asked to pay off a fee in exchange for membership and sometimes products. The money gained is then used to pay off the people on top of the pyramid. The products are used by pyramid schemes to support their front as a multi-level marketing business and to deter authorities. But they sell their products mostly to their members instead of consumers.

Pyramid schemes often promise high rewards for the recruitment system, which is mathematically destined to crumble down as less people can be recruited by the ones at the bottom of the pyramid. They are left with losses while those at the top of the pyramid run off with everybody else’s money. This is why it’s illegal.

They have now progressed to selling cryptocoins. OneCoin promoters were slapped with a €2.6 million fine this year after being found guilty of pyramiding.

It doesn’t matter what new terms they use to disguise themselves next time—MLM, networking, what have you. Recognize them when you see them.

Ponzi scheme

Pretty much like the pyramid scheme, a Ponzi scheme’s success relies heavily on recruiting more investors. Except in a Ponzi scheme, the investors are not made aware of the fact that their earnings come from the recruits. The organizers of the Ponzi are made to believe that the money they put in has generated profit due to the successful business practices of the organizers.

These scams involve promising high percentage profits at a very fast pace, referred to as a “high yield investment program (HYIP).” It encourages recruitment of more “investors” but under the guise that this will collectively increase the profits of their ventures. The company will, for some time, be paying out profits—encouraging more and more people to cash in. Then out of nowhere, the website disappears and the company wipes out any trace of their existence online, leaving investors dumbfounded after going all in.

Today, they pose as cryptocoin sellers, but you have to pay a minimum “cash in.” These also sometimes comes in the form of companies posing as mining pools, exploiting the popularity of Bitcoin and Ethereum. Some also use cryptocoins as the “investment product”—these coins can be existing or made up, and they invite people to buy coins “before prices go up.” Some also pose as “trading experts” who will grow your investments for you.

While there are traders out there who trade other people’s money for a living, these are professionals who have licenses. They usually earn percentages of the profits they make for their clients. On the other hand, scammers do not give you any explanation as to how they earn profits. They just drop a humongous number on your lap, hoping to blind you into submission.

Why is this not worth your time? First of all, you are entrusting a bunch of unlicensed, unregulated strangers with your money. Their selling point is that this way, you get “experts” to trade for you, followed by made-up statistics of unusually high profits. But this begs the question: if they are really making that much, why do they need your money to make more money? Shouldn’t they be super rich by now that they don’t need anybody else’s money, and they wouldn’t have the time (or need) to work for someone else?

A professional high-rolling trader is also probably not advertising their services to a mass of small-time investors. So what’s in it for these “experts?” Charity? Philanthropy? Pure, unadulterated altruism? Bite me.

ICOs

Initial coin offerings (ICO) have become a hot topic in recent years. Scammers jumped in on the trend and exploited the ability of ICO’s to generate huge amounts of funds without a company even starting. All they do is hype up an ICO, perhaps even create a whitepaper without any intentions of really pushing through with promises. They then launch an ICO, wait for their coin to rise in value, and then sell all their coins to a different coin, ultimately abandoning the project and the investors as their investments plummet.

As a result, the SEC went on a crackdown on ICO’s and declared that they may be subject to federal securities laws: “Depending on the facts and circumstances of each individual ICO, the virtual coins or tokens that are offered or sold may be securities. If they are securities, the offer and sale of these virtual coins or tokens in an ICO are subject to the federal securities laws.”

China issued a complete ban on ICO’s in the country recently, with South Korea declaring they would follow suit.

Pump and dump

This is when a group of individuals rig the market by buying a bulk of a certain cryptocoin in advance, then hype it up and convince more people to buy in. As more people keep buying, the value of the coin rises. This means that the instigator’s investments have grown, hence, the “pump.” As soon as the value reaches a certain increase, the instigator (or instigators) of the pump then dump the coins by selling off to a different coin, securing their profits before the coin’s value nosedives and the other investors lose.

The new-age Nigerian Prince

Ah, the man of our dreams. For some reason, he still wants to give you money—except now he’s on the blockchain.

The original Nigerian prince scam claims to have a huge sum of money that needs to be transferred, but he would need an initial deposit for some fees because his money is “trapped in the bank,” and your information so he can verify your identity before sending you the money. The thief will then run away with the deposit or steal your identity.

Today, this comes in the form of fake high yield investment programs online, using cryptocoins to lure people in.

Tell-tale signs that you’re dealing with a scammer

These are some commonalities that scammers share. There may be people out there who are guilty of blowing things out of proportion or bragging about things without any intention of conning you into anything, so don’t jump into accusing someone of being a scammer just because they test positive in one or two of these.

When cornered with a binding contract or any form of paper trail, they either lash out or run.

If they even tell you their real full name, they probably don’t want any paper trail that may be legally used against them later on.

They like to show you “their wallet.”

The same way “networkers” pose beside sports cars that aren’t theirs, cryptocoin scammers will show you wallets with huge amounts of coins in them. They usually don’t own this either. It’s a marketing material. Whales don’t usually show the contents of their wallets to people they just met.

Everything about them and their company is so legendary that they are exactly what you think they are: myths.

This is what makes unsophisticated scammers so freaking hilarious. They would say all sorts of incredibly farfetched trivia if they think it will get you to bite the bait. I once heard a Ponzi scheme marketing themselves as a company run by a member of the Illuminati who “secretly runs the whole cryptocoin trading ring in the country.”

I don’t even know what any of that means, but just don’t tell anyone. It’s a secret.

Whether this is funny or just downright insulting to your intelligence depends on your usual temperament. Now if you have a very low tolerance for BS, brace yourself: they are not going to stop precisely because they are prone to…

Verbal diarrhea

To scammers, silence is deadly. It’s an indication that the person is thinking—which is the worst thing anyone can do. Scammers need to take and maintain control of the conversation. If he or she lets you direct the conversation with your logical nonsense, his deception train will get derailed. They want you to think they know everything about everything. This gives them a false image of authority, which is a powerful persuasion tool.

Overblowing credentials and affiliations

Don’t be fooled by anyone’s selfie with reputable personalities in the industry. This doesn’t mean the famous person trusts him. Again, this is a marketing tool. Scammers can use celebrities, personalities, anyone famous, or even someone you know in hopes of transposing some of that trust to themselves. Same with their credentials, but a quick Google search should be a good weapon for cross-checking facts.

How do you protect yourself?

Quickest answer: research. Educate yourself. But with many people presenting themselves as experts (I am not), sometimes it’s hard to weigh things. Here are some tips that might help.

- The worst person to ask whether you should buy a blender is the guy trying to sell you a blender.

When doing your research or background check on a certain coin, trading platform or anything else, look for outside sources of information and people who have no vested interest in getting you to whip your wallet out. Check out Reddit threads and other cryptocurrency forums. There are also Facebook communities dedicated to answering questions for beginners. Never ask people who themselves are selling the coin or product for obvious reasons. You know how that will go.

I’m not saying all salespeople are liars. But you should do your due diligence through a balanced, unbiased medium.

- Get rich quick: if it’s too good to be true, it probably is.

No one can make guarantees as to how much you will earn from cryptotrading, or any trading, for that matter. Cryptocurrency values are, in fact, far more volatile than fiat currencies. There are several factors affecting these values—most of which are unpredictable and are NOT under anybody’s control. Remember when JP Morgan CEO Jamie Dimon out of nowhere lambasted bitcoin? Who could’ve precisely predicted something like that? How about the infamous DAO heist that sent Ethereum plummeting for the rest of last year? You get the point.

Anyone promising guaranteed profits and percentages is, at the very least a moron, if not a blatant liar. Let’s not discount the fact that some genuinely do not realize they are a part of a scam. This doesn’t absolve them of any wrongdoing, of course. Stupidity is still largely frowned upon, after all.

- Resist the FOMO.

Resist the urge to jump on bandwagons. Pump and dump schemes feed on people’s fear of missing out.

- The hard sell

You see those ads promising a four-inch increase in penis size? Cryptocurrency scams are the penis enlargement ads of the blockchain age. They follow the same formats in ads and messages: big promises, no risks, with immediate actions needed unless you want to miss out (see number 3). Familiarize yourself with their branding.

- Read, research, stalk.

I can’t say this enough. Do your research. Choose reputable sources and check out forums about each organization. Do a background check on the names of the people behind the coin or company. Stalk them online, if you must, to verify if they are who they say they are. If they list or mention specific information about themselves, cross-check these with information online. If there are barely any results on who they are, thread lightly. This could mean they are shady.

Often, organizations have dedicated forums that are open to the public. You can ask questions there to get a better feel of how the organization handles its operations and make better assessments for yourself. Check their whitepapers: coins are supposedly issued as a token from a certain technology or company. If there is no viable business and system behind it, you can very well guess that this coin was made solely for the purpose of launching an ICO. Prepare to have your heart (and wallet) broken by the pump and dump that follows. If you’re not skilled at deciphering whitepapers, again, there are forums on Reddit and Facebook that are beginner-friendly.

As more technologies develop, there is without a doubt that more scams will come into existence. There may be even more scams in existence as we speak. Arm yourselves with knowledge and keep one eye open for suspicious offers.

Finally, when in doubt, remember that Google is your friend.

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.