Bitmex released their own Tether report and things are not looking good.

Shady history

From the name itself, Tether (USDT) supposedly serves as an anchor, a base currency that keeps itself to a 1:1 proportion with the US dollar. For those who are “betting” and profiting from the wild fluctuations of cryptocurrencies, it is a stable ground to which you can move your funds in order to protect it at times when cryptocurrencies are crashing. So there are two main reasons to buy Tether—to be able to trade cryptocurrencies, and to protect existing funds from dropping. Sounds simple enough.

But recent events have brought to light suspicions of foul play, with users accusing Tether of printing tokens out of thin air—that they are making more Tethers than there are US dollars coming in. Suspicions of Tether conniving with cryptocurrency exchange Bitfinex and using these fraudulent Tethers to pump up the price of legacy Bitcoin (BTC) have been rising throughout last year. In November, Tether suffered a $31 million hack and this brought them back in the spotlight, with the US Commodities Futures Trading Commission (CFTC) slapping the two with a subpoena.

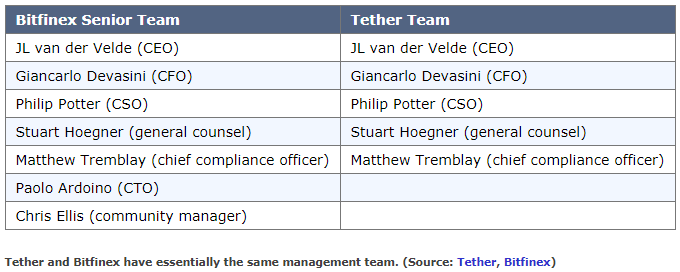

The disturbing trend was that they would lie for as long as possible before finally admitting that mainstream rumours were right—such as the time when they downplayed the relationship between Tether and Bitfinex. Former Bitfinex CTO Craig Sellars, going by the user name udecker on Reddit, said Bitfinex was just a customer of Tether.

After being pressured into transparency presumably by the CFTC subpoena, Tether finally released their team members’ list and—surprise, surprise, it was a copy-paste of the top five members of Bitfinex.

Much like the way they downplayed the connection between Tether and Bitfinex, they seem to be downplaying the subpoena as well, trivializing it as part of “routine.”

“We routinely receive legal process from law enforcement agents and regulators conducting investigations,” Bitfinex and Tether reportedly said in an article by Bloomberg.

While the dubious duo thinks (or would like the public to think) this isn’t a big deal, Hong Kong-based exchange Bitmex has published an analysis of the situation saying otherwise.

Bitmex report

To mitigate the November hack, Tether initiated a hard fork to freeze the stolen funds and demanded that users upgrade to the hard forked software. According to Bitmex, the implications of this action are disturbing for users.

“The hacking incident demonstrated that Tether is effectively in complete control of the ledger, as they can force a hardfork at will and reverse any transaction — although there may not have been any doubt about Tether’s control beforehand,” Bitmex writes.

To put this into context, one of the pledges of blockchain technology is immutability—which means no one, not even a financial institution, could easily tamper with or corrupt the records, at least not without a fight. When the DAO was hacked, Ethereum needed consensus to trigger a hard fork to undo the heist, and this led to the birth of Ethereum Classic (ETC) because some believed the DAO should not be bailed out and must suffer the consequences of their own negligence. Code is law after all.

That Tether can easily do this without the need to subject themselves to checks, audits and approval, and force users to comply, violates this principle. Furthermore, Bitmex raises the question as to why they’re even built on a blockchain.

“This raises the question of why Tether bothers to put the database on the Bitcoin and Ethereum blockchains at all — it would be far cheaper for Tether to create its own public database without needing to pay fees to the miners. Although the Tether company was and is able to freeze funds, the process is technically difficult and time consuming, as it requires new software to be written and released and for all Tether exchanges to upgrade,”according to Bitmex’s report.

Puerto Rico, the crypto paradise

Although Bitmex reiterates that “lack of transparency does not indicate fraud” from the part of Bitfinex and Tether, they state that Tether has some lapses in terms of KYC compliance which would make banks cautious in dealing with them. This is consistent with Bitfinex critic and active online investigator Bitfinex’ed’s suspicions that no bank wants to partner up with Tether/Bitfinex.

At least not in the US.

This brings us to crypto utopia Puerto Rico, the “crypto tax paradise.”

“Generally speaking, the IRS does not require a US taxpayer to include income from “sources within Puerto Rico” if they have resided in Puerto Rico for an entire taxable year,” CoinTelegraph reports. But there is still a possibility that the IRS can chase down sales tax through regulations governing “property of former US residents.”

And according to Bitmex, the rumours that Tether may be banking in Puerto Rico are not completely unfounded.

“We noticed strong growth in the cash balance (and the deposit balance) in the International Financial Entities (IFE) banking category. This sharp increase in cash reserves could be related to Tether. It is also possible for this growth to be related to a non-Tether aspect of the crypto currency ecosystem — for example, plans to make Puerto Rico a crypto utopia,” Bitmex writes.

They zeroed in on Noble Bank as the primary candidate, since they are one of only two full-reserve banks in Puerto Rico that could provide the needs of Tether. Plus, it has been dallying in the crypto space since 2015.

If true, Bitmex says this would mean that Tethers may all be backed by US dollars as they claim. But they have another equally grave problem that could prompt US authorities to shut them down.

“These characteristics may make the system attractive for criminals and money launderers — and if criminal activity becomes too prevalent, the authorities may wish to shut the system down. This has already happened numerous times in the past, as the case studies below (Liberty Reserve, GoldAge, e-Bullion, E-gold, etc.) demonstrate. In a later report, we may dig into the history of these case studies in more detail.”

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.