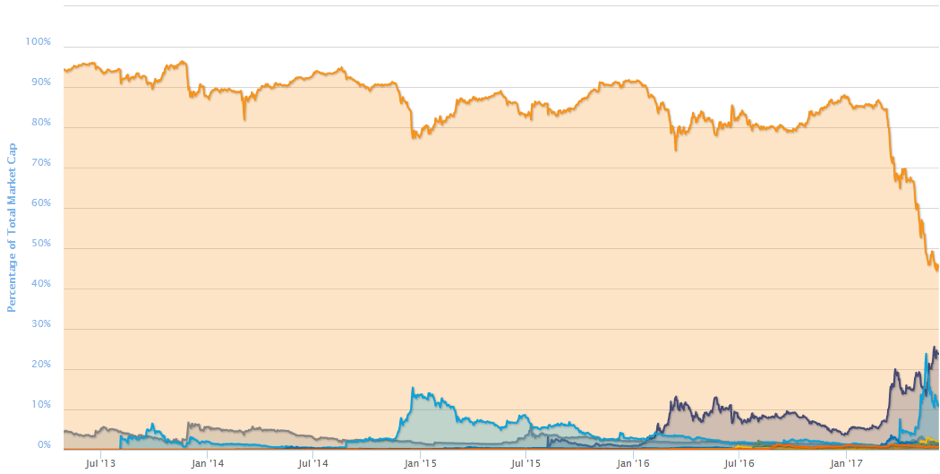

While many Bitcoiners out there are thoroughly enjoying this bull market, and of course a rising price is a sign of positive sentiment, it must be stated that all other indicators don’t look so good. Bitcoin’s price may very well continue to swell in the near future, but have a look at Bitcoin’s market cap dominance among cryptos, and suddenly it’s not a pretty picture.

The era of Bitcoin superiority is quickly coming to an end. Ethereum is likely poised to take the market cap crown, but there’s no guarantee, particularly with the fast emergence of other coins also gaining on Bitcoin’s losses.

If we look at today’s numbers, Bitcoin would be valued over $5000 USD per coin had it not been for its diminishing network effect.

Rising fees are an issue.

One myth that needs to be quashed is that Segregated Witness is a scaling solution. Segwit’s scaling capability is completely dependant on a fully implemented Lightning Network, something which has not yet been deployed holistically. The otherwise mild blocksize increase that Segwit does offer is not enough to correct today’s congestion issues.

Today, I firmly believe that Bitcoin’s rising prices are simply due to the investment opportunity. Good things in life start at the most common denominator. If you cannot transfer $10 without paying half of that value in fees, then users will easily use another coin for that transaction.

People often compare changing coins to the network effect of social media networks. It’s not the same sport. In crypto-land, you don’t need to transfer all your photos, media, friends, followers, and everything else onto a new system. You simply download a new wallet, and use it.

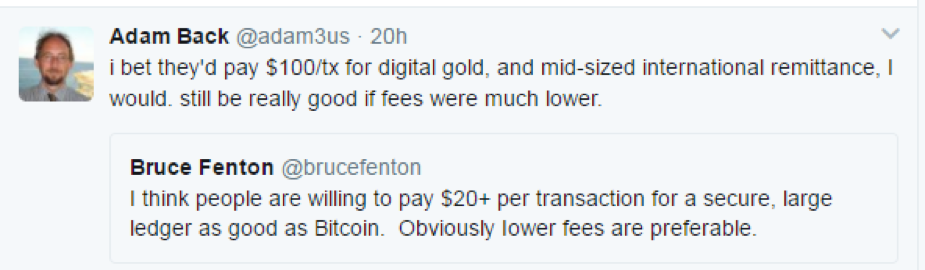

Adam Back CEO of Blockstream recently tweeted that he bets “they’d” pay $100 per transaction. Key word “they”. Clearly, Adam is not a user of the very system he is supposedly care-taking.

Bruce Fenton replies with a similar comment, and reaffirms Bitcoin’s large, secure ledger. But what happens when Ethereum reaches the same “secure, large ledger”. By what rationale will people use Bitcoin, and lose $20 per transaction over Bitcoin?

Its no secret, Blockstream employees openly say fees are a good thing. Gavin Andresen, the man who was entrusted by Satoshi to carry on the development of Bitcoin following his departure, recently stated “I was wrong, stay away from Blockstream…”.

Unless you are compromised, you’d have a hard time not seeing the blatant attack on Bitcoin, and the resulting effect.

I recently put out a small sample survey asking people if they thought that if another coin was to take the mantle off Bitcoin, would the next coin suffer similar attacks. Overwhelmingly people responded with ‘Yes’.

So I ask myself, if Bitcoin is intentionally being crippled, would these same entities that are pulling strings put the same resources into attacking yet another coin, and then yet another coin, and another coin, in an endless spiral? It’s a question to ponder.

But here we are nearing the moment of the ‘fippening’; When another coin takes the throne. And it will happen – unless the community becomes one voice, and miners hear them.

Admittedly I’ll be disheartened should Blockstream win this war. Because it will be a win for oppression, a win for centralized governance, and it will be a loss for people, and a loss for those with a voice.

Eli Afram

@justicemate

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.